Navigating China’s Economic Landscape

Tuesday’s data revealed that China’s economy surpassed expectations with faster growth in the first quarter, providing a degree of reassurance to officials amidst ongoing efforts to bolster growth amidst challenges in the property sector and increasing local government debt.

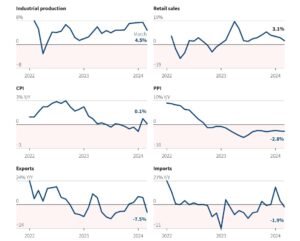

Nonetheless, accompanying indicators for March, such as property investment, retail sales, and industrial output, underscored the persistent fragility of domestic demand, hampering overall economic momentum.

The government has introduced a series of fiscal and monetary policy measures in an effort to achieve what analysts consider to be an ambitious GDP growth target of around 5% for 2024. Analysts point out that last year’s growth rate of 5.2% may have been inflated by a rebound from the COVID-affected 2022.

Data from the National Bureau of Statistics revealed that gross domestic product (GDP) expanded by 5.3% in January-March compared to the previous year. This figure surpassed analysts’ expectations, with a Reuters poll anticipating a 4.6% increase, and slightly outpaced the 5.2% expansion recorded in the preceding three months.

Assessing First Quarter Growth and Ongoing Challenges

“The robust growth seen in the first quarter significantly contributes to China’s goal of achieving ‘around 5%’ growth for the year,” stated Harry Murphy Cruise, an economist at Moody’s Analytics. “Industrial production remained supportive throughout the quarter, but the sluggish March data raises some concerns. Equally worrisome is the continued reluctance of Chinese households to spend.”

Quarter-on-quarter, GDP expanded by 1.6% in the first quarter, surpassing forecasts for growth of 1.4%.

The world’s second-largest economy has faced challenges in achieving a robust and enduring recovery from the COVID-19 pandemic. These challenges include a prolonged downturn in the property sector, increasing local government debts, and subdued private-sector spending.

Fitch recently revised its outlook on China’s sovereign credit rating to negative, citing concerns about public finances. This revision comes as Beijing directs more spending towards infrastructure and high-tech manufacturing.

Navigating Economic Headwinds: Assessing China’s Growth and Stimulus Efforts

To stimulate economic growth, the government is relying on infrastructure projects—a familiar strategy—to compensate for cautious consumer spending and businesses’ hesitancy to expand. The economy started the year on a strong note, but March data concerning exports, consumer inflation, producer prices, and bank lending indicate a potential slowdown, prompting calls for additional stimulus measures to support growth.

Furthermore, separate reports on factory output and retail sales, released alongside the GDP figures, underscored the ongoing weakness in domestic demand. In March, industrial output grew by 4.5% year-on-year, falling short of the forecasted 6.0% increase and lower than the 7.0% growth recorded in the January-February period. Retail sales, a key indicator of consumption, rose by 3.1% year-on-year in March, below the expected 4.6% increase and a decline from the 5.5% growth observed in January-February.

Fixed asset investment expanded by 4.5% annually in the first quarter of 2024, surpassing expectations for a 4.1% rise. This growth follows a 4.2% expansion in the January-February period.

“On the surface, the headline number seems promising… but in reality, the momentum appears quite fragile,” remarked Alvin Tan, head of Asia FX strategy at RBC Capital Markets in Singapore.

Revising Growth Forecasts Amidst Persistent Challenges

Before the data release, analysts surveyed by Reuters anticipated China’s economy to grow by 4.6% in 2024, falling below the official target. Following the positive outcome of the first-quarter GDP, economists at ANZ revised their 2024 China growth forecast upward to 4.9% from the previous 4.2%, while BBVA maintained their projection at 4.8%.

Despite the better-than-expected GDP figure, many investors remained cautious due to the weakness evident in the March data. Consequently, China’s state-owned banks were observed selling dollars to stabilize the yuan in the onshore market. Additionally, China stocks were tracking lower alongside broader markets, influenced by geopolitical tensions in the Middle East dampening risk sentiment.

China’s economy continues to grapple with the fallout from the property sector crisis, affecting business and consumer confidence, investment, hiring, and stock prices. March data revealed ongoing troubles in the sector, with investor confidence and demand remaining low.

Navigating Property Sector Woes, Export Downturns, and Geopolitical Risks

New home prices dropped at the fastest rate in over eight years, while property investment and sales plummeted significantly year-on-year. Furthermore, with the Federal Reserve and other developed economies holding interest rates steady, China faces prolonged subpar export growth. Geopolitical tensions with the United States further compound challenges for policymakers.

While the People’s Bank of China plans to increase policy support, concerns arise as credit flows more towards production than consumption, exposing structural weaknesses in the economy. Looking ahead, uncertainties persist regarding the real estate market adjustment, local government debt, and geopolitical risks stemming from China-U.S. tensions.

Comments 1