Shares of alcoholic beverages (AlcoBev) companies were in high demand, surging up to 14 percent on the BSE during Wednesday’s intra-day trading due to heavy volumes and a positive business outlook. In India, per capita alcohol consumption is anticipated to gradually increase, with a projected rise of 0.1 liters (2 percent) between 2024 and 2029, reaching a peak of 5.06 liters by 2029.

This growth is driven by factors such as rising incomes, urbanization, greater access to alcoholic products, and a trend towards premiumization. Additionally, younger consumers are contributing to market expansion, supported by demographic shifts, an expanding middle class, and increasingly favorable government policies.

This growth is driven by factors such as rising incomes, urbanization, greater access to alcoholic products, and a trend towards premiumization. Additionally, younger consumers are contributing to market expansion, supported by demographic shifts, an expanding middle class, and increasingly favorable government policies.

Tilaknagar Industries (TI), the fourth-largest Indian-made foreign liquor (IMFL) player, saw its stock surge 14 percent to Rs 250. TI, known for India’s highest-selling premium brandy, Mansion House Brandy, sells over 15 different brands of brandy, whisky, gin, rum, and vodka, primarily in the Prestige & Above (P&A) segments. Brandy, the second-largest product category within IMFL, holds over 20 percent of the industry’s volume share, with the premium brandy sector expected to continue expanding its market share within the P&A IMFL segment.

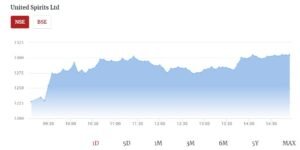

Radico Khaitan rose 10 percent to Rs 1,724 on the BSE in intra-day trade. United Spirits (USL) hit a record high of Rs 1,305, surging 8 percent and surpassing its previous high of Rs 1,245.15 touched on May 8, 2024. USL has projected back-ended growth in FY25, with muted volumes in H1 (April to September) due to a high base last year and subdued demand, but strong growth expected in H2 (October to March). USL continues to invest in a broader portfolio, with innovations in products like Godawan single malt, Don Julio, and McDowell’s single malt whisky, according to analysts at Elara Capital.

Other Alcohol stocks

Among other stocks, Sula Vineyards and United Breweries each soared 7 percent, reaching Rs 516.15 and Rs 2,069.30, respectively.

Globally, India is poised to become the fifth-largest contributor to the AlcoBev market’s revenues in the near to medium term, reflecting a broader trend of emerging markets influencing global economic dynamics. The Indian AlcoBev sector not only highlights the country’s growing influence in global markets but also underscores the economic opportunities arising from its internal market dynamics and demographic advantages, as noted in Sula Vineyards’ FY24 annual report.

India’s Alcohol Bev industry is projected to experience significant growth, with the market size expected to reach $64 billion by 2030, up from $52.4 billion in 2021, representing an annual increase of 6.54 percent between 2023 and 2027. The market is forecasted to grow from approximately $55 billion in 2024 to around $112 billion by 2034, with a 7.2 percent CAGR. This growth is driven by demographic trends, evolving consumer lifestyles, and shifting cultural perceptions regarding alcohol consumption, according to the company.