The National Payments Corporation of India (NCPI) released its latest update on Unified Payments Interface (UPI) transactions for the month of May on Saturday. The update shows a boost in both transaction volume and value.

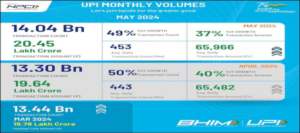

According to the NCPI, the transaction volume surges to 14.04 billion, from 13.30 billion in the previous month marking a notable increase.

This surge follows a slight dip in transaction volumes in April, where the network saw a 1 per cent decline to 13.3 billion transactions from 13.44 billion in March.

In terms of transaction value, UPI transactions totalled ₹20.45 lakh crore in May, reflecting a rise from ₹19.64 lakh crore in April. The average daily transaction count on UPI reached 453 million and the average daily transaction value for the month stood at ₹65,966 crore.

The UPI update shows a 49 percent year-on-year transaction count while the transaction amount showed a 37 percent year-on-year growth.

United Payments Interface or UPI developed by the NCPI has been a success in digitizing the payment structure in India. This has boosted transactions in the country. UPI has now gained popularity in other countries like France, and it has already been operational in Singapore and the UAE.

Stakeholders shared strategies for scaling up UPI infrastructure, expanding the product portfolio, addressing challenges in the ecosystem, and integrating potential users into the digital payments system, the release added.

RBI’s report on UPI

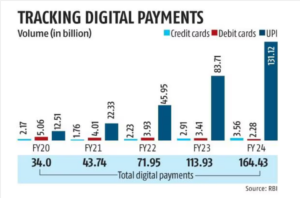

The annual report of RBI says that four out of five transactions in the country were conducted on the Unified Payments Interface (UPI) in the financial year 2024 (FY24).

UPI’s share, compared to the cumulative volume of digital payments in the country, has grown from 73.4 per cent in FY23 to 79.7 per cent in FY24. In FY20, UPI’s share as compared to the volume of total digital payments in India was pegged at 36.8 per cent.

The report further added that the Payments Infrastructure Development Fund (PIDF) has aided in the growth of digital payments in the last financial year, the RBI said. Deployments of Point of Sale (PoS), mobile PoS terminals, and interoperable Quick Response (QR) codes, among others, have been subsidised under the scheme.

UPI QR codes increased 35 per cent on a Y-o-Y basis to 346 million codes at the end of FY24. The report mentions about the plan to take UPI International, announcing the plan to expand to 20 countries by 2028-29.