Reliance Industries (RIL), headed by billionaire Mukesh Ambani, unveiled its quarterly earnings for the January to March period on Monday. Following this announcement, numerous brokerages have revised their target prices upwards for the company’s stock. According to a report from ET by Nikhil Agarwal, the surge in target prices was spurred by optimistic comments from RIL’s management concerning the reduction in capital expenditures (capex) and the potential rise in telecom tariffs.

Annual performance

Annual performance

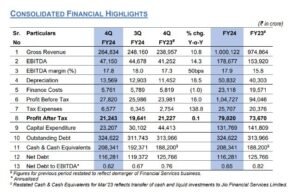

– Reliance Industries recorded Gross Revenue of ₹ 1,000,122 crore ($ 119.9 billion), marking a 2.6% year-on-year increase, driven by sustained growth in consumer businesses and upstream operations.

– Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) surged by 16.1% year-on-year to ₹ 178,677 crore ($ 21.4 billion), with positive contributions from all major operating segments.

– Depreciation rose by 26.1% year-on-year to ₹ 50,832 crore ($ 6.1 billion) due to expanded asset bases across various businesses and increased network utilization in the Digital Services sector.

– Finance Costs increased by 18.1% year-on-year to ₹ 23,118 crore ($ 2.8 billion), attributed to higher liability balances and elevated market interest rates.

– Tax Expenses grew by 26.2% year-on-year to ₹ 25,707 crore ($ 3.1 billion), driven by the utilization of tax credits from the previous financial year.

– Profit after tax saw a 7.3% year-on-year increase, reaching ₹ 79,020 crore ($ 9.5 billion).

– Capital Expenditure for the fiscal year ending March 31, 2024, amounted to ₹ 131,769 crore ($ 15.8 billion), allocated towards initiatives such as nationwide 5G deployment, expansion of retail infrastructure, and investment in new energy ventures.

RIL Stock performance

Despite a 14% surge in RIL’s stock this year, trading remained stagnant on Tuesday morning following the earnings announcement. Nonetheless, brokerages remain bullish, with many raising their target prices to as high as Rs 3,500.

Brokerage Insights

Global brokerage firm Jefferies has increased its target price for Reliance Industries (RIL) to Rs 3,380, anticipating a 14% EBITDA growth in FY25, primarily fueled by expected tariff hikes in Jio.

UBS predicts RIL’s retail business sales to rise in the short term, attributing it to increased sales per square foot from recent store openings.

Macquarie maintains a neutral stance but has upped its target price to Rs 2,630. Morgan Stanley remains bullish, with a target price of Rs 3,046. Bank of America (BoFA) and Bernstein have target prices of Rs 3,250 and Rs 3,160, respectively.

Expectations of RIL

Nuvama, a domestic brokerage, holds the most optimistic outlook with a target price of Rs 3,500, citing RIL’s new energy projects as drivers for future growth alongside its traditional businesses. Reliance Retail’s slower year-on-year growth, at 11%, is attributed to store restructuring and a higher baseline.

Nuvama, a domestic brokerage, holds the most optimistic outlook with a target price of Rs 3,500, citing RIL’s new energy projects as drivers for future growth alongside its traditional businesses. Reliance Retail’s slower year-on-year growth, at 11%, is attributed to store restructuring and a higher baseline.

Equirus Securities notes that the ongoing decline in discretionary spending has posed challenges, although Reliance Industries maintained a robust operating margin of 7.4% in the recent quarter. Despite expectations for continued weakness in the near term, Reliance Retail is seen as having significant potential in the Indian market. Equirus forecasts a compound annual growth rate (CAGR) of 13% in revenue and 16% in EBITDA between FY24 and FY27.

Regarding concerns over debt and capital expenditure (capex), analysts suggest these worries may be overstated. They anticipate Reliance Industries’ net debt to gradually decrease due to moderated capex, funded by increased internal cash generation.

Comparison of Q3 and Q4 results

In the latest financial report, Reliance Industries showcased robust performance:

– Gross revenue stood at ₹ 264,834 crore ($ 31.8 billion), marking a 10.8% year-on-year increase, driven by strong growth in the oil-to-chemicals (O2C) and consumer businesses. Notably, the oil and gas segment saw a significant 42.0% revenue surge, primarily due to higher volumes from the KG D6 block.

– Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) rose by 14.3% year-on-year to ₹ 47,150 crore ($ 5.7 billion), with robust contributions from all business segments.

– Jio Platforms Limited (JPL) and Reliance Retail Ventures Limited (RRVL) both witnessed notable increases in EBITDA, driven by factors such as sustained subscriber additions and business efficiencies.

– Despite a challenging margin environment, the O2C segment demonstrated resilient EBITDA performance, partly offsetting lower transportation fuel cracks with reduced SAED impact.

– Depreciation increased by 18.5% year-on-year to ₹ 13,569 crore ($ 1.6 billion) due to expanded asset bases across various businesses and higher network utilization in the Digital Services segment.

– Tax expenses saw a sharp increase year-on-year to ₹ 6,577 crore ($ 789 million) due to availing tax credits in the corresponding quarter of the previous year.

– Profit after tax showed a marginal year-on-year improvement, reaching ₹ 21,243 crore ($ 2.5 billion).

– Capital expenditure for the quarter ending March 31, 2024, amounted to ₹ 23,207 crore ($ 2.8 billion).