New Zealand’s Double Dip Recession

Official data released on Thursday revealed that New Zealand has entered its second recession in a span of only 18 months.

Factors such as adverse weather conditions and measures to combat inflation have significantly impacted the economy, with a 0.1 percent contraction in output recorded in late 2023, following a 0.3 percent decline in the preceding quarter.

This downturn follows a similar economic contraction experienced in late 2022 to early 2023.

The recession, defined as two consecutive quarters of contraction, has led to widespread effects, with consumers cutting back on spending and businesses in various sectors reducing costs and delaying investments.

Much of the blame is directed at the central bank, which aggressively raised interest rates to combat soaring prices. Cyclone Gabrielle and other extreme weather events in the country’s north also contributed to the economic downturn.

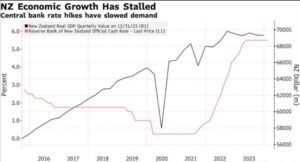

Rising Interest Rates and Economic Contraction

The Reserve Bank of New Zealand raised its target interest rate 12 times from mid-2021, reaching the current rate of 5.5 percent. Jarrod Kerr, chief economist for Kiwibank, criticized the central bank’s approach, warning that the rapid increase in interest rates has led to the contraction in the economy.

Interest rate increases are implemented to temper economic growth and alleviate inflationary pressures or asset bubbles. However, they can also dampen economic activity by making borrowing more expensive.

Despite a surge in migration, with approximately 130,000 individuals arriving in New Zealand last year and increasing the population to 5.3 million, the economy experienced a contraction. Jarrod Kerr emphasized the significance of this contraction, noting that even with the influx of migrants contributing to demand, the economy remains weak.

According to StatsNZ, wholesale trade, particularly grocery and liquor wholesaling, experienced the most significant decline, exerting a considerable drag on the economy.

Retail Sector Struggles and Business Closures

Additionally, the retail sector faced challenges, with decreases observed in furniture, electrical, and hardware retailing. The impact on businesses is evident, with vacuum retailer Godfreys announcing the closure of all its stores in New Zealand and Australia after entering administration.

This decision affects approximately 141 stores and more than 600 employees. In light of these economic challenges, the International Monetary Fund has recommended that New Zealand reduce government spending to combat inflation. However, such measures could potentially slow down economic growth and increase pressure on the central bank to lower interest rates.

Finance Minister Nicola Willis attributed the economic decline to the previous centre-left Labour administration, which was ousted in the October general elections.

New Government’s Fiscal Reforms

She characterized the downturn as a consequence of excessive spending and taxation during their tenure, emphasizing the current government’s commitment to rebuilding the economy following what she termed as years of economic mismanagement.

Prime Minister Christopher Luxon outlined plans for cost-cutting measures, including job reductions in the public sector, with the ministries of health and primary resources being among the initial targets.

Luxon stressed the necessity of reining in government spending and ensuring its alignment with economic realities. Opposition finance spokesperson Barbara Edmonds criticized the lack of policies from the new government to address the cost-of-living crisis faced by New Zealanders, highlighting the ongoing challenges without corresponding policy responses.