Stocks of Indian companies that generate a significant portion of their revenue from rural areas are showing signs of recovery. Traders are optimistic that abundant monsoon rains will lead to improved crop yields and increased rural demand.

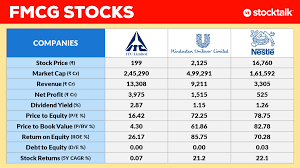

Manufacturers of motorcycles, farm equipment, and fast-moving consumer goods have seen their stocks rally, spurred by predictions of timely and above-normal monsoon rains in 2024. This comes after the last two years were marred by extreme and unseasonal heat that severely impacted Indian agriculture. Sales volumes in rural areas are on the rise, and several major consumer goods companies are forecasting stronger business prospects.

The Nifty FMCG Index has gained 1.5% in May so far, outperforming the benchmark NSE Nifty 50 Index by over two percentage points. This marks a reversal from its underperformance over the past six months.

“The market anticipates a resurgence in rural demand due to a favorable monsoon,” stated Sahil Kapoor, a strategist at DSP Mutual Fund in Mumbai. Should the forecasts for an above-average monsoon this year prove accurate, it would enhance agricultural output and bolster rural incomes, he added.

“The market anticipates a resurgence in rural demand due to a favorable monsoon,” stated Sahil Kapoor, a strategist at DSP Mutual Fund in Mumbai. Should the forecasts for an above-average monsoon this year prove accurate, it would enhance agricultural output and bolster rural incomes, he added.

A recovery in rural stocks is also positive news for India’s broader stock market, which has seen significant gains driven largely by investment-heavy companies benefiting from increased government infrastructure spending. Moreover, abundant rainfall could assist the central bank’s efforts to curb inflation by stabilizing food prices, thereby enhancing the prospects for India’s economic growth and corporate earnings.

Hindustan Unilever and Dabur India Signal Gradual Demand Improvement amid monsoon rains

Hindustan Unilever Ltd., considered a benchmark for consumer demand in India due to its wide product reach, has indicated a gradual improvement in demand. Similarly, Dabur India Ltd. has expressed optimism, while Hero MotoCorp Ltd., a leading motorcycle manufacturer, has reported that most of its new vehicle inquiries now come from rural areas.

Hindustan Unilever Ltd., considered a benchmark for consumer demand in India due to its wide product reach, has indicated a gradual improvement in demand. Similarly, Dabur India Ltd. has expressed optimism, while Hero MotoCorp Ltd., a leading motorcycle manufacturer, has reported that most of its new vehicle inquiries now come from rural areas.

“We believe the rural economy is beginning to recover,” said Rajeev Agrawal, a fund manager at New York-based DoorDarshi India Fund. “This is reflected in strong sales of two-wheelers.”

Motorcycle and scooter sales in India increased by 33% year-on-year last month, according to data from the Federation of Automobile Dealers Associations. More broadly, fast-moving consumer goods companies saw a 7.6% year-on-year sales growth in rural areas in the quarter ending March, based on Emkay Global Financial Services Ltd.’s research citing Nielsen data. This marks the first time in three years that rural sales growth has outpaced urban growth.

However, there are concerns about the sustainability and extent of the rural sector’s demand recovery, considering a low base for earnings comparison and some firms benefiting from price cuts.

“This is still a hopeful trade,” said DSP Mutual Fund’s Kapoor. “There hasn’t been a significant recovery in earnings or sales volumes so far.”

Analysts at Morgan Stanley believe cyclical businesses are still driving India’s growth, which should result in defensive sectors lagging. “We are still mid-cycle for staples and expect them to continue underperforming and de-rating,” they wrote in a May 9 note.

Nevertheless, investor interest in stocks linked to the rural sector has grown amid signs that India’s investment-driven growth may be slowing.

Shares of Mahindra & Mahindra Ltd., a maker of farm equipment such as tractors, have risen about 17% this month, making them the top performers among 16 Indian automakers. The stock jumped 6% on Friday to a record high following better-than-expected fourth-quarter earnings, with some analysts predicting improved tractor sales due to expectations of normal monsoons.

Hero MotoCorp’s shares have climbed 12% this month.

A significant decline in machinery imports in the January-March quarter was an early indication of weakening capital expenditure, according to analysts Prateek Parekh and Priyanka Shah at Nuvama Institutional Equities. Valuations of both consumer goods and capex-heavy firms have converged, which is another reason to shift focus toward consumption themes, they added.