Market experts anticipate volatility in the upcoming trading session, with attention drawn to the range of 22,550-22,600 as a crucial hurdle for the market.

Should the market decisively close above this range, it may pave the way for the Nifty 50 to advance towards the 22,800 and subsequently the 23,000 levels. Conversely, the range of 22,300-22,200 is identified as a critical support zone for the index. Experts note that the decreasing volatility has provided significant reassurance to bullish investors.

On April 5, the BSE Sensex inched up by 21 points to reach 74,248 following the Monetary Policy Committee’s decision to maintain the repo rate at 6.5 percent for the seventh consecutive time. Meanwhile, the Nifty 50 slipped by 1 point to settle at 22,514, forming a bullish candlestick pattern with a lower shadow on the daily charts, suggesting a buying interest at lower levels. Friday’s trading session indicated that the market had already factored in the outcome of the RBI policy meeting.

For the week, the index recorded a gain of 0.84 percent. Tejas Shah, a technical research expert at JM Financial & BlinkX, noted that the ongoing consolidation is expected to persist within the range of 22,200 to 22,550 levels over the next few days. He emphasized that 22,300 serves as an immediate support level for the Nifty, while a broader support zone lies between 22,150 and 22,200.

Similarly, Amol Athawale, vice president of technical analysis at Kotak Securities, highlighted that 22,200 or the 20-day SMA (Simple Moving Average) would be critical support levels for traders. He suggested that maintaining levels above this mark could sustain positive momentum in the market.

He mentioned that on the upper end, the market might encounter resistance around the 22,600-22,800 range. Additionally, he added that sentiment could shift if the index drops below the 22,200 mark.

15 markers for the market in play today:

The pivot point calculator suggests that the Nifty 50 could encounter resistance at levels of 22,524, 22,561, and 22,603, with immediate support anticipated at 22,451, followed by 22,425 and 22,383.

Bank Nifty

Bank Nifty

On April 5, the Bank Nifty responded positively to the outcome of the RBI policy meeting, surging by 432 points to reach 48,493. This marks the third consecutive session of an uptrend, accompanied by above-average trading volumes. The index now stands just 143 points away from its record high of 48,636, set on December 28, 2023.

Throughout the week, the Bank Nifty formed a long bullish candlestick pattern on the weekly charts, posting a gain of 2.9 percent.

Amol Athawale of Kotak Securities highlighted key support zones for trend-following traders at 47,800 and 47,500, while identifying 49,000-49,300 as important resistance areas. He advised traders to consider exiting long positions if the index falls below 47,500.

As per the pivot point calculator, resistance levels for the Bank Nifty are projected at 48,554, 48,725, and 48,978, while support is expected at 48,062, 47,905, and 47,652.

Call options data

According to the weekly options data, the highest Call open interest was observed at the 23,000 strike, totaling 83.62 lakh contracts, potentially serving as a significant resistance level for the Nifty in the short term. This was followed by the 23,500 strike, which held 64.76 lakh contracts, and the 22,800 strike, with 59.95 lakh contracts.

There was notable Call writing activity at the 22,800 strike, with an addition of 38.4 lakh contracts. Similarly, significant Call writing was also seen at the 23,000 and 23,500 strikes, with 37.06 lakh and 33.39 lakh contracts added, respectively.

Conversely, the maximum Call unwinding occurred at the 22,400 strike, where 1.73 lakh contracts were shed. This was followed by the 22,300 and 21,500 strikes, which saw a reduction of 23,450 contracts and 7,050 contracts, respectively.

Put option data

The Put side of the options market revealed significant activity, indicating potential support levels for the Nifty. The 22,500 strike held the highest open interest, followed by the 21,500 and 22,400 strikes. Notable Put writing was observed at the 22,400, 21,500, and 22,500 strikes, while Put unwinding occurred at the 23,200 and 23,100 strikes. Overall, these observations suggest the likelihood of support for the Nifty at these levels.

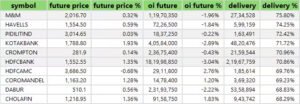

Stocks with high delivery package

Stocks with high delivery package

A high delivery percentage indicates investor interest in a stock. Mahindra and Mahindra, Havells India, Pidilite Industries, Kotak Mahindra Bank, and Crompton Greaves Consumer Electricals witnessed the highest delivery among F&O stocks, suggesting strong investor interest in these companies.

60 stocks see long build-up

Long positions were established in 60 stocks, such as Tata Chemicals, Gujarat Gas, Mahanagar Gas, ICICI Lombard General Insurance Company, and Metropolis Healthcare, as evidenced by an uptick in both open interest (OI) and price, indicating a build-up of bullish sentiment.

26 stocks see long unwinding

Long unwinding was observed in 26 stocks, including Birlasoft, Muthoot Finance, Indian Hotels, Aditya Birla Capital, and SRF, based on the Open Interest (OI) percentage. This decline in both OI and price signifies the unwinding of long positions.

49 stocks see a short build-up

Short positions were established in 49 stocks, such as Bata India, Bajaj Finance, Vodafone Idea, Axis Bank, and Tech Mahindra. This is indicated by a rise in Open Interest (OI) coupled with a decrease in price, signaling a build-up of short positions.

50 stocks see short coverings

50 stocks see short coverings

Fifty stocks were identified on the short-covering list based on the Open Interest (OI) percentage. This list includes Hindustan Copper, City Union Bank, Eicher Motors, Divis Laboratories, and AU Small Finance Bank. Short-covering is indicated by a decrease in OI alongside a price increase.

Pull Call ratio

The Nifty Put Call ratio (PCR) decreased to 1.03 on April 5 from the previous session’s 1.17, indicating shifts in market sentiment. A rising PCR, surpassing 0.7 or reaching above 1, indicates a bullish sentiment, with traders favoring selling Put options over Call options. Conversely, a declining PCR, dropping below 0.7 or nearing 0.5, suggests a bearish sentiment, with a greater tendency towards selling Call options compared to Put options.

FII and DII Data

According to provisional data from the NSE, Foreign institutional investors (FIIs) purchased shares worth Rs 1,659.27 crore, while domestic institutional investors (DIIs) offloaded stocks worth Rs 3,370.42 crore on April 5.

Stocks in News

Wipro’s CEO and Managing Director Thierry Delaporte resigned on April 6, with Srinivas Pallia appointed as the new CEO and MD.

Vodafone Idea obtained approval from its board to raise funds up to Rs 2,075 crore from Oriana Investments, an Aditya Birla Group entity.

Tata Steel reported a 4.5 percent year-on-year growth in India’s crude steel production, reaching 5.38 million tonnes, with deliveries rising by 5 percent to 5.41 million tonnes.

Gland Pharma- the generic injectable-focused pharmaceutical firm has obtained approval from the United States Food and Drug Administration (USFDA) for the Eribulin Mesylate injection.

Cochin Shipyard signed a Master Shipyard Repair Agreement (MSRA) with the US Navy, effective from April 5. This agreement will enable the repair of US Naval vessels under the Military Sealift Command at Cochin Shipyard.

Stock under F&O ban and NSE

The NSE has included Bandhan Bank in the F&O ban list for April 8, while maintaining Hindustan Copper, SAIL, and Zee Entertainment Enterprises on the list. Securities are barred from the F&O segment when derivative contracts exceed 95 percent of the market-wide position limit.