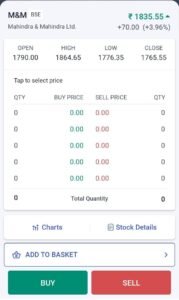

The share price of Mahindra & Mahindra (M&M) rose over 5% to a 52-week high after the business inked a supply deal for Volkswagen components to be used in its electric vehicles.

M&M shares increased by up to 5.61% to ₹1864.65 per share on the BSE.

Volkswagen Group and M&M have agreed to supply MEB components for Mahindra’s purpose-built electric platform INGLO. The contract includes the provision of certain electrical components as well as unified cells. In 2022, the two firms formed a cooperation arrangement and signed a term sheet.

M&M’s share price has climbed by more than 17% in the last three months.

This rise is followed by after M&M shares rose 6.5% on Thursday after the company released its third-quarter earnings.

M&M recorded a standalone net profit of ₹2,454 crore for the quarter ending December 2023, a 61% increase from ₹1,528 crore in the same quarter the previous year. The automotive segment’s strong performance contributed to this gain. In Q3FY24, the company’s revenue climbed by 17% to ₹25,289 crore from ₹21,653 crore year on year.

Deal between Mahindra & Mahindra (M&M) and Volkswagen

Mahindra will be the first external partner to employ Volkswagen’s unified cell idea, central to the company’s battery strategy. M&M stated in a release that the supply arrangement will last several years and have a total volume of around 50 GWh.

According to the statement, the two organizations were considering other collaborative prospects. Beginning in December 2024, Mahindra aims to debut five all-electric SUVs in India based on its new, purpose-built electric platform, INGLO.

Volkswagen has created MEB, a modular, open vehicle platform for EVs, which is utilized to produce its own vehicles as well as those of other group companies such as Skoda and Audi. This also allows Volkswagen to supply other automakers with electric technology and parts.

The relationship with Mahindra is headed by Volkswagen Group Technology’s “Platform Business” section in collaboration with Škoda Auto Volkswagen India Pvt. Ltd, according to the business.

M&M Q3 Results

M&M’s sales market share in the SUV class improved by 40 basis points (bps) to 21% during Q3FY24, up from 19.1% in Q3FY23.

M&M’s sales growth is expected to be driven by a gradual increase in SUV capacity by Q4FY24, as well as strong outstanding reservations and a good new booking rate. According to JM Financial Services, more operating leverage and benign commodity costs are projected to sustain margin performance in the future.

The firm maintained its ‘Buy’ recommendation on M&M with a March 2025 target price of ₹1,850 per share, citing a strong demand tailwind in automotives.

“Our businesses have delivered a solid operating performance this quarter. Auto continues to gain market share and grew rapidly to double its profit. Farm has gained market share despite tough market conditions,” said Anish Shah, MD & CEO, M&M.

Comments 1