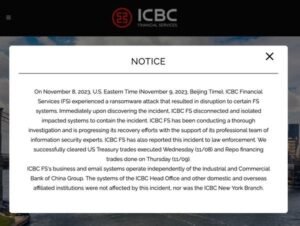

In an unforeseen twist of events, the Industrial and Commercial Bank of China (ICBC), renowned as the globe’s preeminent financial institution, has succumbed to an unrelenting cybersecurity incursion orchestrated by the nefarious LockBit 3.0 ransomware. This malevolent assault has reverberated throughout the financial realm, instigating apprehensions about the susceptibility of even the most formidable institutions to digital threats.

In an unforeseen twist of events, the Industrial and Commercial Bank of China (ICBC), renowned as the globe’s preeminent financial institution, has succumbed to an unrelenting cybersecurity incursion orchestrated by the nefarious LockBit 3.0 ransomware. This malevolent assault has reverberated throughout the financial realm, instigating apprehensions about the susceptibility of even the most formidable institutions to digital threats.

Why has the world’s largest bank become ensnared in the clutches of ransomware?

The vast scale and eminence of ICBC render it an enticing target for cyber malefactors, driven by the prospect of substantial financial gains. Within the intricate labyrinth of ICBC’s systems lies a trove of immense wealth and extensive client data, presenting an irresistible opportunity for those harboring malicious intent. The motivations behind targeting such a colossal financial entity are multifaceted, encompassing financial extortion and geopolitical tensions.

Ransomware

Delving into the realm of ransomware, it emerges as a pernicious form of malevolent software meticulously crafted to obstruct access to a computer system or files until a pecuniary sum, often in cryptocurrency, is remitted to the assailants. This cyber menace has witnessed an escalating prevalence, setting its sights on businesses, governmental agencies, and individuals alike. The repercussions of a triumphant ransomware strike are profound, spanning from financial hemorrhages to reputational tarnishing.

Lockbit

Enter LockBit 3.0, a sophisticated iteration of ransomware that encrypts files within a victim’s system, rendering them inaccessible until a ransom is dutifully paid. This particular version signifies an evolution within the LockBit malware family, renowned for its adaptability and efficacy. The architects of this digital affliction remain shrouded in anonymity, navigating the shadowy realms to evade legal consequences. LockBit 3.0, leaving a wake of digital havoc in its path, has previously targeted diverse organizations globally. Its modus operandi involves infiltrating systems, encrypting invaluable data, and demanding substantial ransoms for the coveted decryption keys. The audacious strike on ICBC’s U.S. subsidiary, disrupting Treasury trading in New York, marks another brazen maneuver by the LockBit syndicate.

Who is responsible?

Attributing the responsibility for this cybersecurity breach is the LockBit group, a notorious cybercriminal consortium functioning as a ransomware-as-a-service (RaaS). This group, rooted in Russian-speaking origins, has orchestrated several high-profile attacks on a global scale. The ICBC incident stands as a testament to their audacious cybercrime spree, underscoring their proficiency in breaching even the most impregnable financial bases.

The LockBit group, the puppeteer behind the malevolent software, has a history of targeting small and medium-sized enterprises and has previously claimed responsibility for ransomware assaults on entities such as Boeing and the UK’s Royal Mail. In June, the U.S. Department of Justice indicted a Russian national for involvement in deploying LockBit ransomware, citing over 1,400 worldwide attacks and ransom demands surpassing $100 million.

What do the perpetrators seek to achieve?

The primary impetus behind the ICBC ransomware assault is pecuniary gain. The LockBit group demands a substantial ransom from ICBC, pledging to decrypt the compromised files and reinstate normalcy to the bank’s operations. The precise amount and terms of the ransom remain clandestine, underscoring the covert and furtive nature of these cybercriminal machinations.

The ramifications of this breach for ICBC

Spanning from immediate fiscal losses to enduring damage to its esteemed reputation, The compromised data potentially includes sensitive client information, opening avenues for identity theft and other fraudulent activities. Furthermore, the disruption to ICBC’s operations resonates on a global scale, impacting markets, investors, and the broader economy.

Possible solutions

Seeking redress from the aftermath of the ransomware assault necessitates ICBC’s expeditious implementation of robust cybersecurity measures. This encompasses fortifying network security, conducting exhaustive system audits, and investing in cutting-edge threat detection technologies. Collaboration with cybersecurity savants and law enforcement agencies is imperative for delving into the incident and unmasking the malefactors. Additionally, ICBC must prioritize enlightening its personnel and clients about cybersecurity best practices to prevent future onslaughts.

- Bolstered Cybersecurity Measures: ICBC must allocate resources to avant-garde cybersecurity technologies to preclude and detect future incursions. The implementation of robust intrusion detection systems, periodic security audits, and sophisticated threat intelligence can fortify the bank’s defenses.

- Employee Training and Awareness: Human fallibility remains a pivotal vulnerability in cybersecurity. ICBC should accord primacy to continual training initiatives, elucidating employees on phishing attacks, social engineering strategies, and optimal practices for digital hygiene.

- Incident Response Planning: Anticipating the inevitability of cyber incidents is imperative. ICBC should formulate a comprehensive incident response plan, delineating protocols for identifying, containing, eradicating, and recuperating from cybersecurity breaches.

- Collaboration with Cybersecurity Virtuosos: Enlisting the expertise of cybersecurity virtuosos and threat intelligence services can furnish ICBC with invaluable insights into emerging threats and vulnerabilities. Collaborative endeavors can contribute to proactive defense strategies.

- Regular Software Updates: The currency of all software and systems is pivotal in closing potential ingress points for cyber malefactors. ICBC should accord priority to periodic patching and updates to mitigate known vulnerabilities.

conclusion

The ICBC cybersecurity breach serves as an indelible reminder of the burgeoning menace posed by cyber-malefactors to financial institutions on a global scale. As ICBC grapples with the repercussions of this ransomware onslaught, the incident underscores the imperative for unwavering vigilance and proactive cybersecurity measures in an increasingly digital and interconnected world. The financial sector must coalesce in the face of such threats, sharing intelligence and adopting collective defenses to safeguard the stability of the global economy.