Foreign Portfolio Investors (FPI) have offloaded more than Rs 5,200 crore from Indian equities in April amid concerns over adjustments to India’s tax treaty with Mauritius, which now subjects investments made via the island nation to greater scrutiny. This follows substantial net investments of Rs 35,098 crore in March and Rs 1,539 crore in February, as per depository data.

Himanshu Srivastava, Associate Director at Morningstar Investment Research India, attributes the primary reason for FPI selling to the revised tax treaty with Mauritius, which restricts tax relief for investments benefiting residents of another country. Additionally, V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, cites unexpected US inflation and resultant bond yield spikes, along with heightened tensions between Iran and Israel, as contributing factors to the sell-off.

Domestic institutional investors (DIIs) with ample liquidity, alongside optimistic retail and high net-worth individual (HNI) investors, are expected to absorb much of the FPI selling. Beyond equities, FPIs also withdrew Rs 6,174 crore from the debt market during the same period.

Despite the recent outflows, foreign investors injected Rs 13,602 crore in March and substantial amounts in previous months, driven by the upcoming inclusion of Indian government bonds in the JP Morgan Index. This landmark decision is anticipated to attract significant capital inflows, estimated between USD 20-40 billion over the next 18 to 24 months.

Regarding sectoral preferences, FPIs have been shedding IT stocks on anticipated weak performance in the fourth quarter of FY24, while showing interest in autos, capital goods, telecom, financial services, and power sectors. Overall, equity inflows for the year so far amount to Rs 5,640 crore, while debt market inflows stand at Rs 49,682 crore.

What prompted FPIs to break their streak of buying?

What prompted FPIs to break their streak of buying?

Foreign Portfolio Investors halted their buying streak in April, with sales of equity totaling ₹13,546 crore by the 19th of the month. The surge in US inflation, leading to a notable increase in bond yields, notably above 4.6%, prompted significant selling in the Indian cash market.

Dr. V K Vijayakumar highlighted that the total Foreign Portfolio Investor flow for April reduced to ₹5,639 crore, attributing this to FPI investments amounting to ₹22,092 crore in the primary market, which boosted the overall equity flows.

A significant shift observed in Foreign Portfolio Investor activity this month is their transition to sellers in the debt market after several months of sustained buying. As of April 20th, FPIs sold debt worth ₹12,885 crores, influenced by rising US bond yields and concerns regarding rupee depreciation.

In terms of portfolio adjustments, FPIs were major sellers in the IT sector in anticipation of weak Q4 results. Conversely, they showed interest in sectors such as autos, capital goods, telecom, financial services, and power.

FPI activity in Indian markets

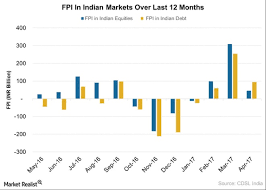

Reflecting on FPI activity in Indian markets, March witnessed a notable inflow of ₹35,098 crore into Indian equities, marking the highest recorded inflows in the first three months of 2024. Despite initially declining FPI  outflows in February, they ended the month as net buyers, driven by high US bond yields. The inflow into Indian equities stood at ₹1,539 crore in February, while the debt market saw an investment rise to ₹22,419 crore, building upon the ₹19,836 crore bought in January.

outflows in February, they ended the month as net buyers, driven by high US bond yields. The inflow into Indian equities stood at ₹1,539 crore in February, while the debt market saw an investment rise to ₹22,419 crore, building upon the ₹19,836 crore bought in January.

The inclusion of government bonds into JPMorgan and Bloomberg debt indices notably spurred foreign fund inflows into debt markets. In January 2024, foreign investors became significant sellers, ending their streak of buying that had surged in December 2023 following a reversal of a three-month selling trend in November 2023.

December experienced heightened inflows due to robust global signals, following indications from the US Federal Reserve signaling the conclusion of its tightening measures and hinting at a rate cut in March 2024. This led to a decrease in US bond yields, prompting increased foreign fund inflows into emerging markets like India.

In total for the calendar year 2023, investments in Indian equities amounted to ₹1.71 lakh crore, with a total inflow of ₹2.37 lakh crore including debt, hybrid, debt-VRR, and equities, according to NSDL data. Net investment in the Indian debt market stood at ₹68,663 crore during 2023. Across 2023, only four months—January, February, September, and October—saw net outflows from Indian equities, while May, June, and July each recorded inflows exceeding ₹43,800 crore.