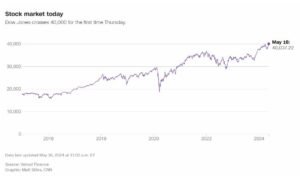

Thursday morning saw the Dow Jones Industrial Average surpassing the 40,000 mark for the first time ever, driven by positive inflation data. The blue-chip index recorded an increase of approximately 114 points, or 0.3%, trading around 40,022 mid-morning.

Following the release of the latest Consumer Price Index, which indicated a slowdown in inflation for the first time in months, markets surged to new record highs on Wednesday. This development fueled optimism that the Federal Reserve might consider initiating interest rate cuts as early as September.

The inflation report revealed a 0.3% increase in prices on a monthly basis, indicating a slower pace compared to the previous two months, as reported by the Bureau of Labor Statistics. Economists, according to FactSet consensus estimates, had anticipated a monthly increase of 0.4%.

The inflation report revealed a 0.3% increase in prices on a monthly basis, indicating a slower pace compared to the previous two months, as reported by the Bureau of Labor Statistics. Economists, according to FactSet consensus estimates, had anticipated a monthly increase of 0.4%.

Another positive factor contributing to the upbeat sentiment was the disappointing April retail sales figures, indicating a potential slowdown in consumer spending, a key driver of the economy. The reported spending fell short of the economists’ projected 0.4% increase.

Market gains were further propelled by strong performances from staple retailers like Walmart (WMT), which exceeded earnings expectations on Thursday morning and saw a nearly 6% rise. Additionally, sectors such as airlines, utilities, and Big Tech stocks generally experienced gains.

Investor sentiment was also buoyed by speeches from Federal Reserve officials on Thursday. New York Fed President John Williams conveyed positive views on inflation trends, while Richmond Fed President Tom Barkin offered optimistic perspectives on April’s subdued retail sales figures.

Another positive factor contributing to the upbeat sentiment was the disappointing April retail sales figures, indicating a potential slowdown in consumer spending, a key driver of the economy. The reported spending fell short of the economists’ projected 0.4% increase.

Gary Pzegeo, head of fixed income at CIBC Private Wealth US, commented on the favorable Consumer Price Index (CPI) report, stating, “This is the first good CPI report in four months and the market likes it.” He noted that when combined with the retail sales data, it supports the expectation of a Federal Reserve rate cut in the fall. Market sentiment suggests anticipation of a rate cut in September, with indications of a second cut by December.

President Joe Biden expressed optimism about the market movement, highlighting the positive impact on Americans’ retirement accounts and portraying it as a vote of confidence in the economy. He emphasized his administration’s efforts to build the economy from the middle out and bottom up, attributing the positive results to their investments.

This is great news for Americans’ retirement accounts and another sign of confidence in America’s economy.

I’m building an economy from the middle out and bottom up – and our investments are making a difference. https://t.co/rF2PFy1fD3

— President Biden (@POTUS) May 16, 2024

Main Street vs. Wall Street

Market gains were further propelled by strong performances from staple retailers like Walmart (WMT), which exceeded earnings expectations on Thursday morning and saw a nearly 6% rise. Additionally, sectors such as airlines, utilities, and Big Tech stocks generally experienced gains.

The Dow’s new milestone, comprising 30 top-tier stocks, signifies a significant change for investors. Despite concerns over rising interest and inflation rates, geopolitical tensions, and recurring recession warnings, investors maintain a positive outlook on the US economy.

This achievement underscores a notable disparity between the sentiment prevailing on Wall Street and that observed on Main Street.

A recent survey conducted by the University of Michigan revealed a stark contrast in consumer sentiment. It indicated a sharp decline to the lowest level in six months, attributed to the resurgence of price increases.

The recent surge in inflation has stirred concerns among Americans about the economy, with recent CNN polls indicating that many perceive the US economy to be on the wrong track. Some individuals even believe that the United States is currently experiencing a recession, although there is no empirical evidence supporting this claim.

According to CNN data from February, 26% of Americans believe that economic conditions have stabilized, while nearly half of the population believes that the economy is still in a downturn.

Despite a remarkable market momentum in the first three months of 2024, during which the S&P 500 reached 22 new records between January 1 and April, market volatility emerged as investors became apprehensive about the prospects of prolonged higher inflation and interest rates.

However, Wednesday’s Consumer Price Index (CPI) report altered this perception. Tyler Schipper, an economics professor at the University of St. Thomas in Minnesota, characterized the report as positive, suggesting that the previous hotter-than-expected CPI reports may have been merely temporary disruptions rather than indicative of a stagnant inflation environment.

Dow crossing 40,000

While surpassing the 40,000 level holds limited practical significance for investors, it garners public attention and, some argue, could help amplify optimistic sentiment beyond Wall Street. Art Hogan, chief market strategist at B. Riley Financial, highlighted the significance of the Dow 40,000 milestone, emphasizing the resilience of the US economy despite previous concerns about a potential recession. He noted that achieving such milestones brings awareness of Wall Street news to Main Street and serves as affirmation of growing corporate earnings and robust investor confidence.

While surpassing the 40,000 level holds limited practical significance for investors, it garners public attention and, some argue, could help amplify optimistic sentiment beyond Wall Street. Art Hogan, chief market strategist at B. Riley Financial, highlighted the significance of the Dow 40,000 milestone, emphasizing the resilience of the US economy despite previous concerns about a potential recession. He noted that achieving such milestones brings awareness of Wall Street news to Main Street and serves as affirmation of growing corporate earnings and robust investor confidence.

For many Americans, “the Dow” symbolizes the stock market. The index’s composition of stocks, which includes prominent companies like Microsoft, McDonald’s, and Chevron, is widely held among both retail and institutional investors.