India recorded a 50 per cent dip in the share of coal in India’s power generation in the first quarter of 2024, the first time since the 1960s.

The POWERup quarterly report from the Institute for Energy Economics and Financial Analysis (IEEFA) showed that in Q1 2024, renewables accounted for 71.5 per cent of 13,669 megawatts (MW) produced in the first quarter. The cumulative power generation capacity reached nearly 442 gigawatts (GW) by the end of March.

India recorded a net coal power capacity addition of 3,193MW during the first quarter taking the total installed base of coal power capacity close to 218GW or 49.2 per cent of the total capacity.

Despite the coal capacity additions in 1Q 2024, given the increasing renewable power capacity installations in recent years, the coal capacity’s share in total power capacity dropped under 50% for the first time. This is in line with the Government of India’s target of establishing 50% cumulative power generation capacity from non-fossil fuel-based sources by 2030.

“A renewables-powered future is now becoming a reality,” said Aditya Lolla, Ember’s Asia programme director. “Solar power, in particular, is growing at an unprecedented pace.”

“Our report concludes that the rapid growth in solar and wind has brought the world to a crucial turning point – likely this year – where fossil generation starts to decline at a global level.”

To accelerate the transition, G7 countries pledged last month to phase out all unabated coal power generation by 2035, building on their commitment to halt all construction of new coal-fired power plants.

At the United Nations COP28 climate change conference in December last year, world leaders reached a historic agreement to transition away from planet-warming fossil fuels and triple the global renewable energy capacity by 2030.

With Green energy up, Coal dependency reduces

India witnessed a record solar power capacity installation of 8.5GW during the first quarter including Adani’s 1.6GW solar project at Khavda in Gujarat.

The Solar capacity additions were at a peak of 8,495MW in this quarter higher than he last peak in Q1 2022 of 4,650MW. The sustained year-on-year increase in energy generation is a reason for this peak. The increase was 33 per cent in 2022 and 163 per cent in 2023. The government has also improved the list of approved list of models and manufacturers (ALMM) from April 1, 2024.

Gujarat, Maharashtra, Tamil Nadu and Rajasthan have been leading in the renewable race by recording the highest installations in Q1 2024. Gujarat and Rajasthan are the main while adding 3,495MW and 2,576MW in Q1 2024.

“Gujarat-based Gujarat Urja Vikas Nigam Limited (GUVNL) has already firmly established itself as one of the leading tendering entities in India. Similarly, the rising prominence of other state-level entities, such as Rajasthan-based Rajasthan Urja Vikas Nigam Limited (RUVNL), underlines the vibrancy of the renewable energy tendering ecosystem,” says the report’s co-author Prabhakar Sharma, senior consultant, JMK Research.

While there is momentum in India’s utility-scale renewable energy market with innovative tenders and high investor interest, obstacles persist, such as the 40% import duties on solar modules and the requirement for developers to purchase locally manufactured components.

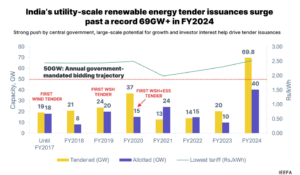

Investments fall to the lowest in the last five quarters due to continued high interest rates and policy uncertainty. According to the Indian government estimates, India will witness a surge in investments this year and will attract about US$16.5 billion into the renewable energy sector in 2024.