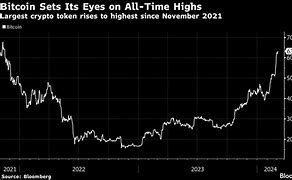

Bitcoin surged to a two-year high on Monday, breaching above $65,000 as a rush of money pushed it closer to record heights.

The price reached a session high of $65,537 early in Europe, after setting a record two-year high in Asian trade. It was last up 4%, to $65,045. In November 2021, bitcoin reached a record high of $68,999.99.

The largest cryptocurrency by market value has increased by 50% this year, with the majority of the increase occurring in the previous few weeks as inflows into U.S.-listed bitcoin ETFs skyrocketed.

Legalization in US

Spot Bitcoin exchange-traded funds were legalised in the United States early this year. Their introduction paved the path for new major investors and reignited excitement and momentum, reminiscent of the run-up to record levels in 2021.

“The flows are not drying up as investors feel more confident the higher the price appears to go,” said Markus Thielen, head of research at Singapore’s 10x Research.

According to LSEG statistics, net flows into the ten largest U.S. spot bitcoin funds were $2.17 billion in the week ending March 1, with BlackRock’s iShares Bitcoin Trust receiving more than half of that total.

Other small rivals

Smaller competitor ether has risen on predictions that it, too, would soon have exchange-traded funds driving inflows.

It’s up 50% year to date and was trading at two-year highs on Monday, up 2.6% to $3,518.

The surge has coincided with record highs on stock indexes ranging from Japan’s Nikkei to the S&P 500 and tech-heavy Nasdaq, as well as reduced volatility indicators in equities and foreign currency.

“In a world where Nasdaq is making new all-time highs, crypto is going to perform well because bitcoin remains a high-volatility tech proxy and liquidity thermometer,” said Brent Donnelly, trader and president of analytical company Spectra Markets.

Comments 1