State-owned Bharat Heavy Electricals Limited (BHEL) reported a consolidated net profit of Rs 489.62 crore for the January-March quarter (Q4) of the financial year 2023-24 (FY24). This represents a 25.6 percent decline compared to the Rs 658.02 crore net profit reported during the same period last year, primarily due to increased expenses. However, sequentially, the company’s net profit increased sevenfold from Rs 60.31 crore. Consolidated revenue from operations saw a slight year-on-year (Y-o-Y) increase of 0.4 percent, rising to Rs 8,260.25 crore from Rs 8,226.99 crore. Sequentially, revenue grew by 50 percent from Rs 5,503.81 crore.

Total expenses for Bharat Heavy Electricals Limited (BHEL), a manufacturer of power and industrial equipment, increased by 5 percent year-on-year to Rs 7,794.11 crore in the fourth quarter, up from Rs 7,411.64 crore. Compared to the previous quarter, expenses surged by 40.75 percent, rising from Rs 5,537.47 crore. BHEL accounts for 53 percent of the nation’s total installed power generation capacity. In comparison, competitor Tata Power reported an 11 percent increase in consolidated net profit, reaching Rs 1,046 crore for the same period. Siemens, on the other hand, saw a 74 percent rise in profit after tax (PAT) to Rs 896 crore, driven by higher revenues in Q4.

BHEL PAT

BHEL concluded FY24 with a 56.85 percent decline in profit after tax (PAT), recording Rs 282.22 crore compared to Rs 654.12 crore at the end of FY23. Revenue from operations for the fiscal year increased by 2.3 percent year-on-year to Rs 23,892.78 crore, up from Rs 23,364.94 crore. Meanwhile, the company’s expenses rose by 4.6 percent, reaching Rs 24,260.37 crore, compared to Rs 23,193.98 crore the previous year. The company’s board has recommended a dividend of 25 paise per equity share with a face value of Rs 2 for FY24. Upon approval, the final dividend will be paid within 30 days of the Annual General Meeting (AGM).

BHEL concluded FY24 with a 56.85 percent decline in profit after tax (PAT), recording Rs 282.22 crore compared to Rs 654.12 crore at the end of FY23. Revenue from operations for the fiscal year increased by 2.3 percent year-on-year to Rs 23,892.78 crore, up from Rs 23,364.94 crore. Meanwhile, the company’s expenses rose by 4.6 percent, reaching Rs 24,260.37 crore, compared to Rs 23,193.98 crore the previous year. The company’s board has recommended a dividend of 25 paise per equity share with a face value of Rs 2 for FY24. Upon approval, the final dividend will be paid within 30 days of the Annual General Meeting (AGM).

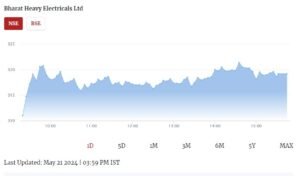

Shares of BHEL closed trading at Rs 319.2 on the BSE, ahead of the company’s fourth quarter earnings report on Tuesday.