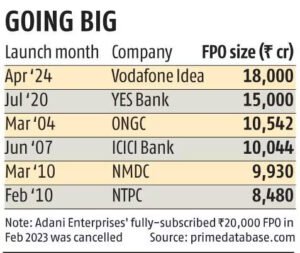

On 10 April, Vodafone Idea had announced the opening of its follow-on public offer (FPO) on April 18, aiming to raise Rs 18,000 crore. With a floor price set at Rs 10 per share and a cap at Rs 11, the FPO will run until April 22. The company has appointed Jefferies, SBI Caps, and Axis Capital as lead managers for the FPO, which is considered one of the largest offerings in India. Investors can participate with a minimum bid lot of 1,298 equity shares, and subsequent bids can be made in multiples of the same. This move follows the company’s board approval in February to raise up to Rs 20,000 crore through equity.

Vodafone Idea has recently secured Rs 2,075 crore by issuing preferential shares to Oriana Investments Pte Ltd, a promoter entity linked to the Aditya Birla Group. These shares were priced at Rs 14.87 each, marking a substantial increase of 40% from the floor price set for the FPO.

Vodafone Idea has recently secured Rs 2,075 crore by issuing preferential shares to Oriana Investments Pte Ltd, a promoter entity linked to the Aditya Birla Group. These shares were priced at Rs 14.87 each, marking a substantial increase of 40% from the floor price set for the FPO.

In addition to the equity raise target of Rs 20,000 crore, the telecom giant is reportedly in discussions with banks to arrange debt funding, potentially totaling Rs 45,000 crore when combined with equity.

According to a recent report by brokerage CLSA, Vodafone Idea’s shares may face downward pressure, potentially dropping to Rs 5, as the company has lost around 17 million subscribers over the past year.

Vodafone Idea could potentially encounter financial strain in the fiscal year 2026 due to upcoming payments amounting to up to $4 billion for annual spectrum and AGR dues. This situation might arise unless the government opts to convert debt principal into equity following the moratorium period. As per reports, the brokerage has upheld its “sell” rating on the stock.

Despite doubling in value over the past year, Vodafone Idea’s shares have undergone a correction of 30% from their recent peak. Furthermore, for the April 12 session, the stock is under the F&O ban, indicating that no new positions can be initiated.

As of 9:35 am, Vodafone Idea’s shares were trading 2% lower at Rs 12.65 on the National Stock Exchange and the close was reported at 13.15 INR.

Explaining FPO

Vodafone Idea Limited (VIL) is launching its Follow-on Public Offering (FPO) on April 18, 2024, aiming to raise Rs. 18,000 crore (approximately $2.2 billion). A Follow-on Public Offering (FPO) is a process through which a publicly traded company issues additional shares to the public after its initial public offering (IPO). The main purpose of an FPO is to raise additional capital for the company. This capital can be used for various purposes such as funding expansion plans, reducing debt, financing research and development activities, or simply increasing the company’s cash reserves.

Why Vodafone Might Be Participating in the FPO?

Due to sustained operational losses, Vodafone Idea has trailed behind its competitors in investing in network expansion and emerging technologies like 5G. Over the past three years, the company has only invested approximately Rs 48,000 crore in capital expenditure (capex), which is less than half of Bharti Airtel’s roughly Rs 1.12 trillion and one-fifth of Reliance Jio’s Rs 2.5 trillion capex during the same period.

Due to sustained operational losses, Vodafone Idea has trailed behind its competitors in investing in network expansion and emerging technologies like 5G. Over the past three years, the company has only invested approximately Rs 48,000 crore in capital expenditure (capex), which is less than half of Bharti Airtel’s roughly Rs 1.12 trillion and one-fifth of Reliance Jio’s Rs 2.5 trillion capex during the same period.

Additionally, Vodafone Idea’s spending on marketing and brand promotion is notably lower compared to others in the industry. Consequently, there has been a consistent decline in subscribers and revenue stagnation. From its peak of 333.6 million active subscribers in May 2019, the number has dwindled to 215.2 million by December 2023. This decline has notably benefited Reliance Jio and Bharti Airtel.

What does this mean for the company?

- Improved Financial Position for VIL: If the FPO is successful and raises the targeted

amount, VIL will have access to much-needed funds to implement its turnaround strategy and become more competitive.

amount, VIL will have access to much-needed funds to implement its turnaround strategy and become more competitive. - Enhanced Network and Services: The FPO funds could be used to improve VIL’s network infrastructure and expand its service offerings, potentially leading to a better customer experience.

- Increased Competition: Increased financial resources for VIL could intensify competition in the Indian telecom market, potentially benefiting consumers with lower prices and better services.

However, there are also potential risks:

- FPO Failure: If the FPO doesn’t receive enough interest from investors, it could further strain VIL’s financial situation and raise doubts about its future.

- Market Saturation: Increased competition in the telecom market due to the FPO funds might lead to price wars, potentially hurting profitability for all players.

Overall, Vodafone’s participation in the FPO is a crucial step for VIL’s future. The success of the FPO will depend on various factors like investor sentiment, market conditions, and VIL’s ability to utilize the funds effectively. It remains to be seen whether this FPO will be the financial boost VIL needs to become a stronger player in the Indian telecom landscape.