Amazon India has recently unveiled a fresh shopping category dubbed “Bazaar” within its Android app platform, focusing on budget-friendly, unbranded fashion and lifestyle goods. This strategic inclusion signals a significant move by the e-commerce titan to cater to a wider range of consumer preferences.

In a statement provided to Business Today, an Amazon India spokesperson expressed enthusiasm about the launch, highlighting the company’s ongoing commitment to enhancing the customer experience and supporting third-party sellers. The spokesperson emphasized the platform’s dedication to showcasing affordably priced fashion and home products sourced primarily from manufacturing hubs across India. This move underscores Amazon’s dedication to fostering accessibility and diversity within its marketplace, providing shoppers with a diverse array of choices while bolstering opportunities for local sellers.

At present, Amazon India has chosen to prominently feature the Bazaar section within its app interface for a select group of users, suggesting a targeted approach to its rollout.

At present, Amazon India has chosen to prominently feature the Bazaar section within its app interface for a select group of users, suggesting a targeted approach to its rollout.

Earlier this year, reports indicated Amazon India’s efforts to onboard sellers offering unbranded products across categories like apparel, watches, shoes, jewellery, and luggage, all priced below Rs 600.

For Prime subscribers, delivery estimates currently stand at approximately 4-5 days. It was anticipated that Amazon might adjust delivery timelines for this segment, considering the low-cost nature of the items, where swift delivery may not always be a top priority for consumers.

Why did Amazon do this?

The introduction of Amazon Bazaar marks a significant move positioning the company in direct competition with SoftBank-backed Meesho, a contender that has been making strides in the budget e-commerce arena. Additionally, Flipkart also operates a dedicated app, Shopsy, which caters to a similar market segment.

The launch of Bazaar presents an opportunity for Amazon to reach new customer demographics in the Indian market. Historically, the e-commerce giant has enjoyed a strong presence among urban consumers, especially Prime members who value expedited deliveries and access to streaming services like video and music.

According to a January report from research firm Bernstein, Amazon India experienced a modest user growth of 13% in December 2023. This growth was attributed in part to the company’s emphasis on more premium offerings compared to its competitors. Additionally, in 2022, Amazon expanded its presence in the social commerce realm by acquiring Glowroad, a startup specializing in reseller networks.

Amazon might face competition from Meesho

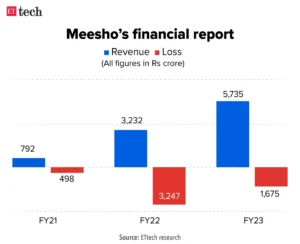

Meesho has been in the market for several years and is starting to gain popularity among the citizens, with its revenue being Rs. 5,735 Cr. This is due to various advantages like:

Meesho has been in the market for several years and is starting to gain popularity among the citizens, with its revenue being Rs. 5,735 Cr. This is due to various advantages like:

- Social Commerce Dominance: Meesho has a strong foothold in social commerce, utilizing platforms like WhatsApp for product discovery and sharing, a network effect that Bazaar may struggle to replicate.

- Early Lead in Value Segment: Meesho has already captured the value-conscious customer base in tier-2 and tier-3 cities, giving it a head start over Amazon Bazaar in this market.

- Zero-commission Model: While both platforms offer commission-free selling, Meesho may have amassed a larger pool of sellers offering trendy, unbranded products.

Potential Edge of Amazon Bazaar

- Brand Trust & Logistics: Amazon’s recognized brand and efficient logistics network could provide a sense of security and faster deliveries, potentially giving it an edge over Meesho.

- Expanded Selection: Leveraging its existing seller base, they could offer a wider range of products beyond fashion and lifestyle items.

- Price Competitiveness: With the elimination of seller commissions, Bazaar could lower product prices and directly compete with Meesho.

Overall Competition Focus

- Seller Onboarding: The ability of Bazaar to attract a critical mass of sellers offering competitive products will be crucial.

- Value Proposition Establishment: Amazon needs to effectively communicate its unique selling points—affordability, wider selection, and brand trust—to value-conscious consumers.

- Social Commerce Adaptation: While replicating Meesho’s social network might be challenging, Bazaar can explore integrating social features to enhance product discoverability.

The rivalry between Amazon Bazaar and Meesho is poised to become significant in the Indian e-commerce landscape, particularly within the value-driven segment.

Comments 1