Aditya Birla Fashion and Retail Limited (ABFRL) emerges profitable by 15% after their demerger on 2nd April.

On Monday, Aditya Birla Fashion and Retail Ltd (ABFRL) revealed its plans to separate its fast fashion and retail division, Madura Fashion & Lifestyle, into a distinct listed entity. This strategic move is intended to unlock potential opportunities for value creation.

Reason behind the demerger

A demerger is a separation of a large company or conglomerate into two or more companies.

According to ABFRL, the proposed demerger will result in the formation of two independently listed companies, each poised to act as distinct growth drivers with their own capital structures and avenues for value enhancement.

In addition, ABFRL plans to raise growth capital within the next 12 months subsequent to the completion of the demerger. This capital infusion is intended to bolster the company’s balance sheet and facilitate the pursuit of significant growth opportunities in the future.

Result of the demerger on share market

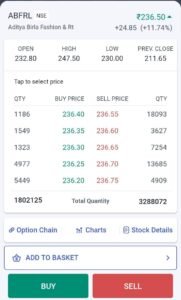

At 09:55 am, Aditya Birla Fashion & Retail was trading at Rs 237.70 on the BSE, marking an increase of Rs 26.00 or 12.28 percent from the previous closing price.

The stock reached an intraday high of Rs 243.45 and a low of Rs 229.70.

Approximately 1.34 crore shares of Aditya Birla Fashion & Retail, accounting for 1.41 percent equity and valued at Rs 322.5 crore, were exchanged at an average price of Rs 243 per share, as reported by CNBC-TV18.

Decoding the demerger behind the surge in stocks

Following the demerger, the restructured ABFRL will concentrate on high-growth sectors benefiting from transitions towards branded goods, premiumization, the emergence of super-premium and luxury markets, and the rapid expansion of digitally oriented brands targeting Generation Z.

Upon finalization of the demerger plan, ABFRL intends to secure additional growth capital within a year to reinforce its financial position. This strategic move aims to position the company favorably to seize the significant growth prospects awaiting it.

The Madura Fashion & Lifestyle (MFL) segment comprises four fast fashion labels: Louis Philippe, Van Heusen, Allen Solly, and Peter England, as well as casual wear brands including American Eagle and Forever 21.

The Madura Fashion & Lifestyle (MFL) segment also holds brand licenses for Reebok sportswear and Van Heusen innerwear, which will be separated into an independent listed entity, as per the announcement.

In the fiscal year 2023, MFL contributed ₹8,306.97 crore to ABFRL’s consolidated revenue of ₹12,417.90 crore.

The portfolio has established a leading position over an extended period and has consistently delivered revenue growth, profitability, robust free cash flows, and high returns on capital. The entity is expected to have a robust balance sheet to support its future growth endeavors.

The MFL business was acquired by the Aditya Birla Group firm in December 1999 from the Indian division of Coats Viyella, a British multinational company specializing in apparel, footwear, and performance materials.

Division of brands

Indian Rayon and Industries, a part of the Aditya Birla Group, acquired Madura Garments for ₹236.23 crore. After the demerger of Madura Fashion & Lifestyle (MFL), ABFRL will focus on Pantaloons, Style Up, ethnic wear, luxury brands like The Collective, Galleries Lafayette, and digital-first brands under TMRW.

The demerger will proceed through an NCLT scheme, with identical shareholding for ABFRL shareholders. Kumar Mangalam Birla highlighted the move’s aim to simplify the structure and enhance stakeholder value. ABFRL post-demerger will emphasize high-growth segments like branded products, premiumization, luxury markets, and digital-first brands.

Positive prospects post-merger

The demerger of Madura Fashion & Lifestyle (MFL) from Aditya Birla Fashion and Retail Limited (ABFRL) marks a significant strategic move aimed at unlocking potential opportunities for value creation. This restructuring enables ABFRL to sharpen its focus on high-growth sectors and capitalize on emerging trends in the fashion and retail industry, such as branded goods, premiumization, and digital-first brands targeting Generation Z.

With the formation of two independently listed entities, ABFRL is well-positioned to enhance shareholder value and pursue significant growth prospects. The division of brands and businesses post-demerger underscores the company’s commitment to streamlining its operations and leveraging its strengths to drive future success.

As ABFRL continues to navigate the evolving landscape of the fashion and retail industry, the demerger sets the stage for sustained growth, innovation, and value creation in the years to come.