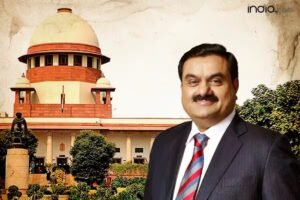

Amidst a momentous twist of fate, Adani shares catapulted to new heights in the aftermath of the recent legal showdown in the Adani-Hindenburg case. Investors bore witness to a substantial augmentation of wealth, as Adani Group entities collectively annexed an astounding Rs 75,000 crore. The buoyant surge in the stock market finds its genesis in the resonating impact of the Supreme Court’s deliberations, serving as a linchpin for bolstering investor confidence.

Adani Group Equities Stage a Rally

The equities of Adani Group companies orchestrated a remarkable surge, registering an impressive upswing of up to 20%, emblematic of a noteworthy ascent in market performance. This surge conspicuously manifested in Adani Power, Adani Ports, and Adani Enterprises. Particularly noteworthy was the 7% uptick in Adani Enterprises’ shares, a testament to a robust market response in the wake of unfolding events.

Reassuring Pronouncements by the Supreme Court

The impetus behind this surge can be traced to the reassuring pronouncements articulated by the Supreme Court during the legal proceedings. The judiciary expressed a lack of grounds to “disparage” the market, extending a vote of confidence in the operational integrity of Adani Group. This judicial imprimatur played a pivotal role in dispelling the clouds of uncertainty enveloping the Adani-Hindenburg case.

Deferred Adani-Hindenburg Case Hearing: Furthermore, the Supreme Court’s adjournment of the Adani-Hindenburg case hearing added another layer to the positive market sentiment. The case, entangled in allegations of market manipulation, has now been slated for a later date, affording investors a respite and assuaging concerns that may have exerted a drag on stock valuations.

Impact on Adani Group Equities

Adani Power, Adani Ports, and other conglomerate stocks experienced substantial upticks, propelled by the court’s pronouncements and the deferment of the case hearing. Adani Enterprises, a diversified conglomerate with stakes in diverse sectors, witnessed a 7% surge in its shares, reflecting a robust response from discerning investors. The surge in Adani Group stocks not only attests to the resilience of the conglomerate but also serves as a barometer of the broader market’s faith in regulatory processes.

Insights from Market Analysts: Per market pundits, the surge in Adani shares finds its genesis in the positive turns of events witnessed during the Supreme Court hearing. Analysts posit that the court’s acknowledgment of the market’s credibility has injected a renewed sense of confidence among investors, precipitating increased buying activity. The market rally is construed as an affirmation of Adani Group’s standing within the business community.

Creation of Investor Wealth

The surge in Adani shares has translated into the substantial creation of wealth for investors. With the collective market capitalization of Adani Group firms surging by over Rs 75,000 crore, investors have reaped significant dividends. This wealth creation not only mirrors the triumph of Adani Group but also underscores the indispensability of regulatory lucidity in sustaining investor trust.

Resilience of Adani Enterprises

Adani Enterprises, the flagship entity of the Adani Group, has exhibited commendable resilience amid undulating market conditions. The 7% surge in its shares amid heightened trading volumes underscores the market’s confidence in the company’s adeptness in navigating challenges. As a conglomerate vested in diverse business interests, Adani Enterprises’ performance often serves as a litmus test for market sentiment.

The Backdrop of the Adani-Hindenburg Case

The Adani-Hindenburg case orbits around accusations of market manipulation, with contentions that Adani Group artificially inflated its share prices. The case has been under the vigilant gaze of investors, regulatory bodies, and the wider business community. The recent developments within the hallowed halls of the Supreme Court have cast a discernible ray of optimism on the situation, providing a glimmer of hope for those invested in Adani Group stocks.

Role of the Supreme Court in Market Equilibrium: The involvement of the Supreme Court in the Adani-Hindenburg case underscores the pivotal role of regulatory bodies in upholding market stability. The judiciary’s unwavering commitment to ensuring a fair and transparent market is paramount in safeguarding the interests of investors. The recent pronouncements by the Supreme Court not only addressed the specifics of the case but also conveyed a broader message about the imperativeness of upholding trust in financial markets.

Looking Forward

As the market assimilates the affirmative reverberations of the Supreme Court’s pronouncements, attention pivots to the future trajectory of Adani Group equities. Investors and analysts alike will be vigilantly monitoring developments in the Adani-Hindenburg case and any ensuing regulatory measures. The tenacity displayed by Adani shares in the face of recent tribulations underscores the inherent robustness of the conglomerate and its acumen in weathering uncertainties.

Conclusion

The surge in Adani shares subsequent to the Supreme Court hearing on the Adani-Hindenburg case stands as a testament to the indomitable resilience of the conglomerate and the salutary impact of regulatory clarity on investor sentiment. As the market negotiates its way through uncertainties, the role of regulatory bodies, exemplified by the Supreme Court, in upholding market stability assumes an increasingly critical status. The wealth creation for investors and the overarching market rally underscore the ineluctable importance of transparent and equitable market practices in fostering enduring investor trust.

Comments 2