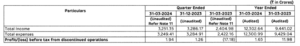

Adani Enterprises Ltd on Thursday reported a drop in profit after tax (PAT). It reported a 39 per cent year-on-year fall in PAT at Rs 449 crores compared to 735 crores in the same quarter last year.

In a report to the BSE, Adani Enterprises also showed a drop in its income of 1 per cent to Rs 29,630 crores from Rs 29,311 crores in the same quarter last year.

EBITDA (Earning Before Interest, taxes, depreciation, and amortization) fell by 8 per cent in this quarter to 3,646 crores from 3,974 crores. ANIL Ecosystem EBITDA rose 6.2 times to Rs. 641 crores while Airports EBITDA was up 130 per cent at Rs. 662 crores, the Adani group flagship said.

Dividend, Record Date

The board recommended a dividend of Rs 1.30 per equity share of face value of Rs 1 each fully paid up. This decision to give dividends is subjected to approval by shareholders of the company at the ensuing AGM.

The firm has decided 14th June 2024 as the ‘Record Date’ for determining the entitlement of the members of the Company to receive a Dividend of Rs. 1.30 (@ 130%) per Equity Share having a face value of Re. 1/- each fully paid up for the financial year 2023-24.

Adani Enterprises Chairman’s response

Group Chairman Gautam Adani said Adani Enterprises has validated its position not only as the premier business incubator in India but also as a global leader in infrastructure development.

“AEL’s resilient growth model of incubation confirms the operational and organizational excellence. This is supported by high ratings and fully funded growth. Our commitment to excellence in project management and operations continues to set global benchmarks, ensuring sustainable long-term value creation for our stakeholders. We remain dedicated to corporate governance, meticulous compliance, robust performance and effective capital flow management,” he said.

Adani Stock falls

The Adani Enterprises stock fell to Rs 3,029 on the 2nd of May. It was on a negative trend and kept falling reaching Rs 2,984 today (Friday).