Analysts suggest that the Rs 3,000-crore initial public offer (IPO) of Aadhar Housing Finance, backed by Blackstone and set to open for subscription on May 8, 2024, is most suitable for investors seeking high-risk opportunities.

This is primarily due to the company’s focus on the low-income housing segment, serving economically weaker and low-to-middle-income individuals. Swastika Investmart analysts advise a prudent stance on Aadhar Housing Finance’s IPO, emphasizing its significant reliance on borrowing and recommending it exclusively for high-risk investors.

Aadhar Housing Finance IPO

Aadhar Housing Finance, a lending institution catering to economically disadvantaged and low-to-middle- income groups in India, specializes in offering mortgage loans of less than Rs 15 lakhs, with an average loan size ranging between Rs 9 lakhs to Rs 10 lakhs, and an average loan-to-value ratio of 58.3 per cent as of December, 2023. With the highest assets under management (AUM) and net worth among its peers in the first nine months of the financial year 2023-24 (9MFY24), Aadhar Housing Finance boasts a widespread presence across 20 states and Union Territories, surpassing its competitors in coverage.

income groups in India, specializes in offering mortgage loans of less than Rs 15 lakhs, with an average loan size ranging between Rs 9 lakhs to Rs 10 lakhs, and an average loan-to-value ratio of 58.3 per cent as of December, 2023. With the highest assets under management (AUM) and net worth among its peers in the first nine months of the financial year 2023-24 (9MFY24), Aadhar Housing Finance boasts a widespread presence across 20 states and Union Territories, surpassing its competitors in coverage.

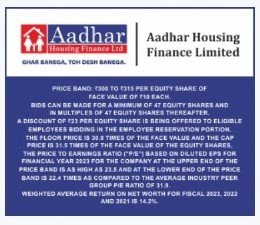

Regarding the Aadhar Housing Finance IPO, priced between Rs 300 to Rs 315 per share, it constitutes a book-built issue of Rs 3,000.00 crore, comprising a fresh issue of 31.7 million shares valued at Rs 1,000 crore and an offer for sale (OFS) of 63.5 million shares worth Rs 2,000 crore.

As of May 7, 2024, the grey market premium (GMP) for the IPO was Rs 70 per share. Investors can bid in lots of 47 shares, with 50 per cent of the offer reserved for Qualified Institutional Buyers (QIBs), 15 per cent for Non-Institutional Investors (NIIs), and 35 per cent for retail investors. The IPO opens for subscription on May 8, 2024, and closes on May 10, 2024, with allotment expected on Monday, May 13, 2024. Shares of Aadhar Housing Finance will be listed on both the BSE and the NSE, anticipated to commence trading on May 15, 2024.

Financial outlook of the company

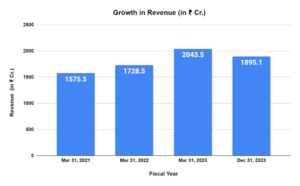

In the first nine months of the financial year 2023-24 (9MFY24), Aadhar Housing Finance recorded a net profit of Rs 548 crore, a significant increase from the Rs 404 crore profit reported in the same period of the previous fiscal year, 9MFY23.

In the first nine months of the financial year 2023-24 (9MFY24), Aadhar Housing Finance recorded a net profit of Rs 548 crore, a significant increase from the Rs 404 crore profit reported in the same period of the previous fiscal year, 9MFY23.

For the entire fiscal year 2022-23 (FY23), Aadhar Housing Finance reported a profit of Rs 544.7 crore, compared to Rs 444.8 crore in the preceding fiscal year, FY22.

The net interest income (NII) for 9MFY24 stood at Rs 948.5 crore, up from Rs 713.8 crore in 9MFY23.

Aadhar Housing Finance achieved a net interest margin (NIM) of 9 per cent for the nine months ending December 2023, showing an improvement from 8 per cent in 9MFY23.

The company’s net worth increased to Rs 4,249.1 crore by the end of December 2023, compared to Rs 3,697.6 crore at the end of March 2023.

Key risks

Analysts cautioned that Aadhar Housing Finance’s reliance on precise data from borrowers and third-party sources is crucial for assessing creditworthiness and collateral value. They highlighted that any misleading information could significantly impact business operations. Additionally, analysts emphasized that failure to identify, monitor, and manage risks, as well as ineffective implementation of risk management policies, could have a substantial adverse effect on the company’s operations.

Should one subscribe? Analysts comment

SBI Securities values Aadhar Housing Finance at a price-to-book value (P/BV) ratio of 2.4x/2.5x based on its 9MFY24 financial data, indicating a favorable valuation range. The company’s strong origination skills, understanding of customer needs, and focus on smaller cities position it well to serve the niche segment, which is expected to contribute to market share growth in the future.

9MFY24 financial data, indicating a favorable valuation range. The company’s strong origination skills, understanding of customer needs, and focus on smaller cities position it well to serve the niche segment, which is expected to contribute to market share growth in the future.

On the other hand, Swastika Investmart suggests subscribing to Aadhar Housing Finance IPO for long-term investors. While acknowledging the company’s status as a leading housing finance company (HFC) with the highest assets under management (AUM) in the low-income segment, they caution about inherent risks linked to the creditworthiness of its low-income clientele and the potential increase in non-performing assets (NPAs). Moreover, operating in a competitive industry and vulnerability to interest rate fluctuations pose additional challenges.