22nd May, Wednesday: One 97 Communications Ltd, which runs Paytm has released their earnings release for the quarter ending March for FY24. Paytm reported a net loss of ₹550 crore in Q4FY24 in its filing to the BSE and NSE.

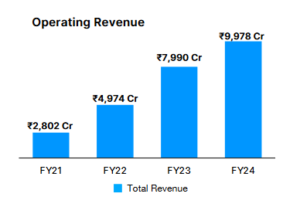

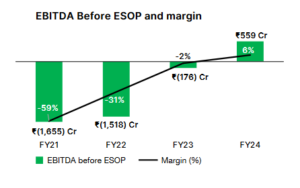

Paytm reported a 25 percent increase in revenue at ₹9,978 crore in FY24. The contribution profit was up 42 percent to ₹5.538 crore, reporting a 56 percent margin, up by 7 percentage points. The EBITDA before ESOP (Employee Stock Ownership Plan) is at ₹559 crores, and the EBITDA margin is at 6 percent, up by 8 percentage points.

The revenue from Payment Services was up by 26 percent to ₹6,235 crore. The net payment margin was up by 50 percent to ₹2,955 crore. GMV was up 39 percent to ₹18.3 lakh crore.

“FY 2024 has been a landmark year for the company as we achieved our first full year of EBITDA before ESOP profitability (since IPO) of ₹559 Cr. We demonstrated strong revenue momentum (up 25%) and continued our disciplined focus on profitability (EBITDA before ESOP margin up by 8%), in spite of regulatory action on our associate entity, Paytm Payment Bank Ltd. (PPBL),” it added.

Paytm reported a revenue of ₹2.267 crore in Q4 FY24, a decline of 3 percent year-on-year. The contribution margin was 57 percent including UPI incentives and 51 percent excluding UPI incentives.

“We are optimizing our cost structure, leveraging AI capabilities, and focusing on our core business will enable us to achieve significant cost efficiencies. This includes creating a leaner organization structure and pruning non-core businesses,” it added.

“I am ensuring that we have greater regulatory engagement and have a higher focus on compliance, in letter and in spirit. I am proud of the talent we have in our company, and the culture of resilience and entrepreneurship. We remain more committed than ever towards growth, profitability, and maintaining robust governance and compliance.”

Subscription merchant additions to recover by Q3FY25

Paytm has set the ambitions to recover the subscription merchants on the platforms with their focus on acquiring new merchants, reactivation of inactive merchants, and redeployment of devices from inactive merchants to new merchants.

The company reported a decline of 10 lakh in active device base due to high attrition in February and March. Further, the active rate and per-device subscription revenue have also been impacted. Merchant subscription revenue in Q4 was ~₹90 per device per month and it is expected to bottom out at ~₹80 in Q1 FY 2025, after which it should increase towards ₹100 by Q4 FY 2025.

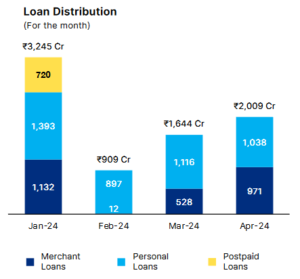

Expanding loan distribution

Consumer Loan

Paytm has decided to pause the business of small personal loans till the credit cycle plays out.

The distribution-only loans have continued to scale, and more lending partners were added during the quarter. In light of deteriorating asset quality, Paytm is targeting prime and super prime category customers.

On the merchant side, Paytm continues to disperse loans where they help with collections and expect collection bonuses on those in the future.

Merchant Loan

This business resumed in March and is seeing good demand. Going forward, they are also expanding by offering larger ticket business loans through a distribution-only model where the lender is responsible for collections.

“Take rate has further increased this quarter as a share of Postpaid loans (lower take rate) has gone down and we continue to receive collection bonus on our erstwhile portfolio. Going forward, we expect the take rate to gradually settle down to the 3-3.5% range considering we will have a higher share of distribution-only loans and focus on the prime customers.”

Paytm’s Stock Price

Shares of One 97 Communications Ltd, operator of Paytm, fell as much as 2% to hit an intraday low of ₹344.5 apiece on the NSE after the release of the earnings report for the fourth quarter and the entire financial year 2023-24.