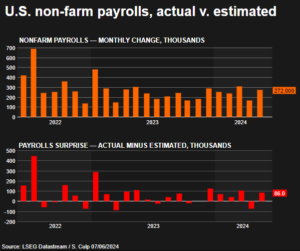

The U.S. economy created far more jobs than anticipated in May, underscoring the resilience of the labor market and diminishing the likelihood that the Federal Reserve will start rate cuts in September. According to the Labor Department’s closely watched employment report, the unemployment rate ticked up to 4.0% from 3.9% in April, a threshold it had maintained for 27 consecutive months.

Despite some softening around the edges, the labor market’s solid performance is poised to support economic growth. This reduces the Fed’s urgency to lower borrowing costs. The hotter-than-expected wage gains suggest that elevated inflation may persist, although the rise in the unemployment rate might temper this effect. Financial markets have adjusted their expectations, reducing the probability of a September rate cut to about 53% from 70% before the report, and now see roughly an even chance of two rate cuts by the end of 2024, down from about 68%.

Despite some softening around the edges, the labor market’s solid performance is poised to support economic growth. This reduces the Fed’s urgency to lower borrowing costs. The hotter-than-expected wage gains suggest that elevated inflation may persist, although the rise in the unemployment rate might temper this effect. Financial markets have adjusted their expectations, reducing the probability of a September rate cut to about 53% from 70% before the report, and now see roughly an even chance of two rate cuts by the end of 2024, down from about 68%.

Expert Insights on Job growth

Brian Jacobsen, chief economist at Annex Wealth Management, remarked, “So much for slowing. The headline payrolls number is eye-popping…. The Fed will take this to mean that they can still focus squarely on inflation without worrying much about growth.” Following the report, the yield on the 2-year Treasury note, which is sensitive to Fed policy expectations, rose significantly. Yields across other maturities also increased sharply, while stocks, particularly after a rally led by the AI sector, retreated, and the dollar strengthened broadly.

Employment Gains

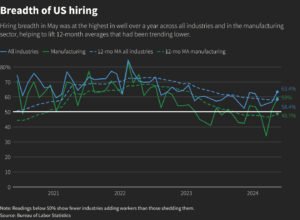

Nonfarm payrolls increased by 272,000 jobs in May, exceeding the 185,000 forecast by economists polled by Reuters. This figure also surpassed the 232,000 monthly average over the past year. Revisions showed 15,000 fewer jobs created in March and April than previously reported. Job gains were widespread, with healthcare adding 68,000 jobs, government payrolls increasing by 43,000, and the leisure and hospitality sector adding 42,000 jobs. Professional and business services also hired 32,000 more workers, with growth in management, scientific and technical consulting services, and architectural and engineering-related services. Social assistance and retail hiring trended upward, while department stores and home furnishings retailers experienced small job losses.

The U.S. central bank is expected to maintain its benchmark overnight interest rate in the current 5.25%-5.50% range during its upcoming meeting. Average hourly earnings rose by 0.4% in May, following a slower 0.2% increase in April. Wages grew 4.1% over the past year, slightly higher than the previous month’s 4.0% annual rise. Wage growth between 3.0%-3.5% is consistent with the Fed’s 2% inflation target. The average workweek remained unchanged at 34.3 hours.

Bill Adams, chief economist at Comerica Bank, commented, “Accelerating pay growth could be a sign of inflationary pressures ready to rebound if the Fed takes their foot off the brake. On the other hand, higher unemployment could signal weaker wage growth ahead, softer consumer demand, and less pricing power for businesses, which would cool inflation.” The Fed closely monitors labor market conditions and economic growth to avoid maintaining high rates for too long, which could overcool the economy while aiming to return inflation to its 2% target.

Divergent Data and Labor Force Participation

In May, the jobless rate reached 4.0%, aligning with the Fed’s March prediction for the end of the year. First-quarter economic output grew at its slowest rate in nearly two years, with other current quarter data showing mixed results. Job openings declined in April, with the number of available jobs per job-seeker reaching its lowest level since June 2021. May’s data also showed a decline in the labor force participation rate to 62.5% from 62.7% in April, driven by fewer workers in the 20-24 age range, while participation among the prime-age population (25-54) rose to its highest level in 22 years.

In May, the jobless rate reached 4.0%, aligning with the Fed’s March prediction for the end of the year. First-quarter economic output grew at its slowest rate in nearly two years, with other current quarter data showing mixed results. Job openings declined in April, with the number of available jobs per job-seeker reaching its lowest level since June 2021. May’s data also showed a decline in the labor force participation rate to 62.5% from 62.7% in April, driven by fewer workers in the 20-24 age range, while participation among the prime-age population (25-54) rose to its highest level in 22 years.

Some economists questioned the divergence between strong job gains and the rising unemployment rate, derived from separate surveys within the report. The Household Survey’s employment measure has fallen in five of the last eight months, showing 250,000 individuals left the labor force in May. Jim Baird, chief investment officer at Plante Moran Financial Advisors, noted, “The employer and household surveys should tell a similar story, but it’s too early to tell whether the recent divergence is a sign of deeper cracks appearing in the foundation of the labor economy or a temporary anomaly.”