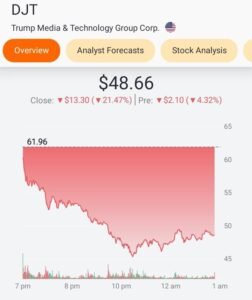

Trump Media’s stock (trading under ticker symbol $DJT, representing Trump’s initials) plummeted by 25% by early afternoon, reaching around $46 per share. This marks a steep decline of approximately 40% from its peak of $79 set just last Tuesday, its inaugural day as an independently traded public company.

Donald Trump, who holds 78.5 million shares in Trump Media, constituting about 57% of all outstanding shares, saw the value of his stake in the social media venture drop from its peak of $6.25 billion to $3.64 billion as of Monday.

The sharp drop on Monday followed the release of Trump Media’s full-year 2023 financial results for the first time, which disclosed annual revenues of $4.1 million alongside a net loss of $58.2 million. Fourth-quarter sales were reported to be approximately $750,000.

Followed by Trump’s Financial Triumph

This fall in DJT’s share follows after the SPAC, Trump Digital World Acquisition Corp, merged with Trump’s enterprise game business, witnessing a rise in its stock since the beginning of this year.

The introduction of Trump Media & Technology Group to the market resulted in a 15 percent increase by the end of the day.

The freshly minted corporation made it’s debut with the prestigious “DJT” ticker symbol, symbolizing the indomitable force of Donald J. Trump. Its grand entrance into the market had been nothing short of revolutionary, catapulting Trump’s wealth to unprecedented heights (though only for short period of time), propelling him into the echelons of the world’s 500 wealthiest individuals for the very first time. Bloomberg estimates his forthcoming fortune to soar to a staggering $4.6 billion, solidifying his status as a financial titan.

The extreme market fluctuations led to such frenetic trading activity that trading had to be halted on Tuesday until the share price found stability. At one point, however, the share price skyrocketed an astonishing 50%.

In the Trump Organization’s case, where legal constraints prevent the president from divesting his stocks, this could serve as the pivotal factor determining the profitability of his holdings. With the stock’s current meteoric rise and fall and again expected rise, Trump stands poised to ascend to the ranks of multi-billionaires upon any future sale.

Trump: Legal Battles and Financial Frontiers

Trump’s unabashed ardor for the platform was unmistakable as he declared, “I ADORE TRUTH SOCIAL,” on the very network that heralded its listing on the Nasdaq.

In the midst of the ex-president’s epic legal saga, wherein he faces an astronomical $454 million claim for purported civil fraud, this economic surge epitomizes the awe-inspiring magnitude of the current American landscape. Nevertheless, the inexorable march of the judicial process shows no signs of relenting, firmly rebuffing any notion of securing a $175 million bail within the forthcoming ten days.

Despite its much-hyped inauguration, the platform has been besieged by a litany of challenges from its very inception, limping along with a paltry $5 million in earnings since the illustrious year of 2021.

SPACs operate precisely in this manner, ingeniously raising private capital through IPOs before meticulously vetting and selecting a company for market listing. Ultimately, SPACs dictate the terms and conditions, culminating in the latest corporation merging with the illustrious SPAC entity introduced to the stock market. This regulatory framework ingeniously ensures mutual benefit for all parties involved. Although initial SPAC investors retain the option to recoup their investments if they cannot withstand the fusion, such a move defies the very essence of SPACs, wherein investors boldly risk their capital to fortify the future of groundbreaking ideas.