The first monetary policy meet for the fiscal year 2024-25 was marked on 5th April. RBI’s Monetary Policy Committee (MPC) leaves the repo rate unchanged at 6.5%, which has been consistent over the last seven times as well. The GDP is predicted to grow to 7%, lower than 7.6% last fiscal.

Prediction of economical developments

RBI’s projections comes after the World Bank’s latest South Asia Development Update, released on Tuesday, forecasts that India’s economy will grow by 7.5% in the fiscal year 2023-2024, followed by a slight moderation to 6.6% growth in the subsequent fiscal year.

The report emphasized that the region as a whole is expected to experience robust growth of approximately 6% in FY24, largely driven by India’s strong economic performance, as well as recoveries in Pakistan and Sri Lanka.

SBI predicts a cut in the third quarter of this fiscal year by RBI. The manufacturing sector has reached a strong peak in the last 16 years due to new orders and enhanced outputs.

The current account deficit (CAD) of India has decreased by 1.2 per cent in Q3, but is predicted to remain both viable and eminently manageable.

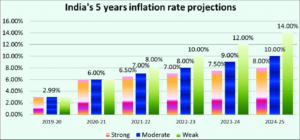

Inflation rates saw an increase in February at 5.09 per cent, when compared to last year, mainly in the volatile food industry. RBI projects this year’s inflation are to remain at 4.5 per cent. But they take the stance to reduce the inflation at the targeted 4 %.

“The CPI, which was the elephant in the room, seems to have taken a stroll and is now on its way back to the forest,” remarked RBI Governor Das.

As of March 29, India’s foreign exchange reserves stand at $645.6 billion. RBI Governor Shaktikanta Das emphasized that our primary goal is to establish a robust reserve of foreign exchange.

No change made by the RBI Governor

No change made by the RBI Governor

RBI Governor Shaktikanta Das has underscored his stance on refraining from considering easing measures until inflation consistently stabilizes around the 4 per sent target, thereby reducing the possibility of an immediate reduction.

Beneficiaries of the unchanged repo rate by RBI

The consistent repo rate will continue to be beneficial for Fixed Deposit (FD) holders with interest rate being charged at 8 per cent normally and even 9 per cent in some of the small finance banks.

Adhil Shetty, CEO of BankBazaar.com, stated that this action is intended to maintain inflation within the targeted range while also upholding market momentum. According to Shetty, a steady repo rate signifies stability in interest rates for borrowers, offering reassurance to homebuyers about consistent loan interest rates. This is advantageous for both new loans and existing ones with variable rates.

Changes/announcements made by RBI in MPC

1. The RBI Governor announced the forthcoming launch of a mobile application designed to streamline retail participation in the government securities market.

2. Governor Shaktikanta Das disclosed the RBI’s proposal to permit cash deposits via UPI.

3. During the MPC meeting, the RBI Governor announced that the RBI would soon introduce a scheme for trading sovereign green bonds at the International Financial Services Centre.

4. The RBI has permitted small finance banks to utilize interest rate futures for proprietary hedging purposes.

5. Wallet holders are now able to make UPI payments without relying solely on the PPI wallet issuer. Instead, individuals have the flexibility to utilize any third-party app for conducting transactions via UPI.

5. Wallet holders are now able to make UPI payments without relying solely on the PPI wallet issuer. Instead, individuals have the flexibility to utilize any third-party app for conducting transactions via UPI.

6. There has been no alteration in the policy stance regarding forex risk management.

7. The Reserve Bank declared its decision to permit the investment and trading of Sovereign Green Bonds (SGrBs) at the International Financial Services Centre (IFSC) located in Gandhinagar.

Anu Aggarwal, President & Head of Corporate Banking at Kotak Mahindra Bank, remarked that the monetary policy stance revealed today indicates a balanced approach by the RBI toward the conflicting goals of growth and inflation. It suggests a strong dedication to fostering growth while maintaining a heightened focus on meeting inflation targets. Aggarwal expressed optimism that this strategy will lead to consistent growth alongside a reduction in inflationary pressures.