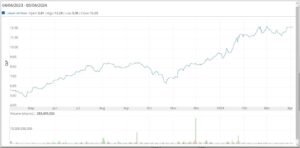

On Wednesday, the board members at LATAM Airlines group nodded in agreement to re-enlist their shares in the New York Stock Exchange (NYSE). This decision was announced on their official website along with fourth quarter results.

Reason behind the re-enlistment

The nod was for the process to begin for re-enlistment of American Depository Receipts (ADRs).

In a recent disclosure to Chile’s stock exchange, the airline unveiled its intentions to relist on the New York Stock Exchange (NYSE), shedding light on a meticulous process expected to unfold over a potential span of six months. The Santiago-based carrier, once a participant in the NYSE trading arena via American Depositary Receipts (ADRs), had encountered a tumultuous phase, declaring bankruptcy back in 2020.

However, in a noteworthy turnaround, the company emerged from the grips of bankruptcy proceedings in late 2022, armed with a robust $8 billion reorganization plan. Now, with aspirations to reclaim its position on the NYSE, the airline faces the arduous task of meeting stringent requirements mandated by both the NYSE and the U.S. Securities and Exchange Commission.

Crucially, the relisting endeavor hinges upon securing consent from the principal creditors who played a pivotal role in steering the company through its Chapter 11 reorganization. Their backing proved instrumental in the airline’s successful emergence from bankruptcy, as underscored in the filing. This consent serves as a linchpin in the company’s bid to resurface on the NYSE, marking a pivotal step in its journey towards financial recovery and market resurgence.

Why the halt in their listing?

LATAM Airlines was removed from the NYSE following its Chapter 11 bankruptcy filing in 2020. Typically, companies undergoing Chapter 11 restructuring fail to meet the listing criteria of major exchanges such as the NYSE. Consequently, LATAM’s American Depositary Shares (ADRs) were delisted, necessitating their transfer to trade on the over-the-counter (OTC) markets.

What exactly led to LATAM Airlines bankruptcy?

In 2020, LATAM Airlines found itself grappling with the profound repercussions of the COVID-19 pandemic, which ultimately led to the company filing for bankruptcy. The pandemic-induced crisis inflicted a dual blow on LATAM, characterized by:

In 2020, LATAM Airlines found itself grappling with the profound repercussions of the COVID-19 pandemic, which ultimately led to the company filing for bankruptcy. The pandemic-induced crisis inflicted a dual blow on LATAM, characterized by:

– Demand Erosion: The imposition of stringent travel restrictions and widespread apprehension surrounding air travel precipitated a dramatic plunge in passenger demand. This sharp downturn in demand left LATAM struggling to generate sufficient revenue to offset its operational costs, intensifying its financial woes.

– Financial Strain: With revenues plummeting, LATAM faced significant challenges in meeting its financial obligations, including servicing its debts. The precipitous decline in income placed immense pressure on the company’s financial health, exacerbating its already precarious situation.

While the COVID-19 pandemic served as the primary catalyst for LATAM’s bankruptcy filing, it’s imperative to examine potential underlying vulnerabilities that may have exacerbated the airline’s plight:

– Debt Complexity: Reports indicate that LATAM’s intricate debt structure could have compounded its challenges. A convoluted debt framework may have hindered the company’s ability to navigate through the crisis effectively, further complicating its efforts to achieve financial stability.

Despite the adversity, LATAM Airlines embarked on a journey of restructuring and revitalization. After successfully navigating the complexities of Chapter 11 bankruptcy proceedings, LATAM emerged from the process in November 2022, marking a pivotal moment in its quest for financial recovery. This milestone was made possible through comprehensive restructuring efforts and securing fresh capital, signifying a resilient stride forward for the airline amidst turbulent times.

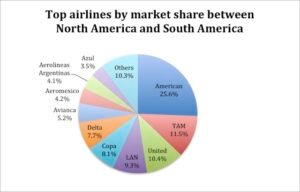

Formation of LATAM Airlines

LATAM Airline group was formed through a merger between the LAN & TAM Airlines and was founded in 1929. The Airlines operate on an extensive network in Latin America, headquartered at Chile.