After reporting flat Q4 numbers for FY24, FMCG major ITC Ltd expressed optimism about a recovery in rural demand, aligning with forecasts by market researcher Nielsen IQ (NIQ). Earlier this month, NIQ noted that rural markets had outpaced urban markets for the first time in 15 months.

On Thursday, ITC reported a 1.3% decline in its standalone net profit for the quarter ending March 2024, totaling ₹5,020.20 crore, due to weak demand during the period. This net profit figure was slightly below the ₹5,150 crore projected by a Bloomberg poll of 20 analysts.

On Thursday, ITC reported a 1.3% decline in its standalone net profit for the quarter ending March 2024, totaling ₹5,020.20 crore, due to weak demand during the period. This net profit figure was slightly below the ₹5,150 crore projected by a Bloomberg poll of 20 analysts.

Revenue from operations increased by 1.4%, reaching ₹17,752.87 crore compared to ₹17,506.08 crore in the same period the previous year. This revenue surpassed the Street estimates of ₹17,191 crore.

However, the company experienced a decline in revenues from its agriculture, paperboards, and paper and packaging segments during the quarter. Expenses for the company rose by 2.4% year-on-year, amounting to ₹12,017.71 crore during the January-March period.

For the full year, ITC’s gross revenue remained flat at ₹69,446.20 crore, while profit increased by 8.9% to ₹20,422 crore. The company stated, “During the year, we reassessed our provisions related to uncertain tax positions from previous years based on a favorable Supreme Court order received this year, resulting in a credit of ₹468.44 crore in the current tax expense.”

Revenue from FMCG (excluding cigarettes) grew 7.1% to ₹5,300.17 crore in the quarter ending 31 March, driven by staples, biscuits, snacks, dairy, homecare, and incense sticks. For the entire year, this segment grew 9.6% year-on-year to ₹20,966.83 crore.

Revenue from FMCG (excluding cigarettes) grew 7.1% to ₹5,300.17 crore in the quarter ending 31 March, driven by staples, biscuits, snacks, dairy, homecare, and incense sticks. For the entire year, this segment grew 9.6% year-on-year to ₹20,966.83 crore.

The FMCG-others segment reported earnings before interest, taxes, depreciation, and amortization (EBITDA) of ₹616.42 crore for the quarter.

Within the FMCG segment, the company noted a sequential rise in certain commodity prices, with competitive intensity remaining high, especially from local or regional players. Revenue from the cigarette segment increased by 7% to ₹7,924.84 crore, significantly exceeding Street estimates. Segment profit before interest and tax (PBIT) rose 5% year-on-year.

“Sharp cost increases in leaf tobacco and other inputs, along with higher taxes, were largely mitigated through an improved mix, strategic cost management, and calibrated pricing,” the company explained.

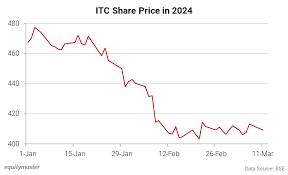

On Thursday, the board recommended a final dividend of ₹7.50 per share. ITC shares closed at ₹441.20 each, up 0.33% on the NSE. Earnings per share for the year stood at ₹16.39, up from ₹15.15.

Revenue from the company’s agriculture business fell by 13.3% year-on-year to ₹3,101 crore in the March quarter.

“The operating environment remained challenging due to various policy interventions by the Government of India aimed at ensuring food security and controlling inflation,” the company stated. ITC experienced a steep rise in green leaf prices, which pressured margins.

“Throughout the year, the agri business segment was impacted by trade restrictions on agri commodities. The strategic portfolio (comprising value-added agri products) and leaf tobacco revenues grew 18% year-on-year in Q4. Geopolitical tensions and climate emergencies have raised concerns over food security and food inflation; government-imposed trade restrictions on agri commodities limit business opportunities for the segment,” the company noted.

Additionally, the National Company Law Tribunal (NCLT) has directed ITC to convene a shareholder meeting on 6 June 2024 to consider and approve the demerger of ITC Hotels Ltd from ITC Ltd.

ITC’s Statement

“Although consumption demand remained subdued in Q4 FY24, improving macro-economic indicators, the prospects of a normal monsoon, and signs of recovery in rural demand after several quarters bode well for a revival in consumption demand in the near term,” the company stated in its earnings release on Thursday.

“By emphasizing consumer centricity, purposeful innovation, agility, and execution excellence, the company is confident in its ability to navigate short-term challenges and create sustained value for all stakeholders,” the company stated.