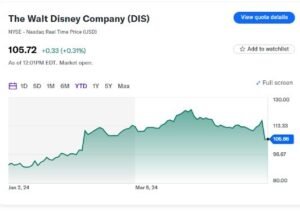

Disney announced that a significant aspect of its streaming business achieved profitability for the first time, but anticipates lower performance in this segment for the upcoming quarter and Q2. This news caused its stock to  drop by almost 10% on Tuesday.

drop by almost 10% on Tuesday.

This projection for upcoming Quarter underscores Disney’s difficulties in maintaining consistent profitability in streaming, which is a crucial focus as its traditional TV business declines. CEO Bob Iger’s recent strategic plan has garnered increased investor optimism towards the stock in recent months. Additionally, Disney recently emerged victorious in a notable proxy battle against activist investor Nelson Peltz.

Disney’s Q2 Results

During Disney’s fiscal second quarter, the direct-to-consumer (DTC) division of its entertainment segment, encompassing Disney+ and Hulu, recorded operating income of $47 million, a significant improvement from the $587 million loss in the same period last year.

However, the company anticipates that the DTC segment within the entertainment division will incur losses in the third quarter, primarily due to deficits stemming from its Indian platform, Disney+ Hotstar.

Furthermore, not all of Disney’s streaming services were profitable in Q2. Despite ESPN+ being included, the total direct-to-consumer losses narrowed to $18 million, compared to the $659 million loss reported in the corresponding period the previous year. Disney projects achieving overall streaming profitability by the fourth quarter of this year.

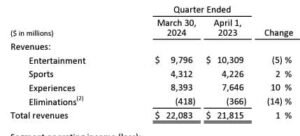

Disney reported adjusted earnings of $1.21 per share for Q2, surpassing analyst expectations of $1.10 and marking an increase from the $0.93 reported in Q2 2023. Revenue stood at $22.1 billion, meeting consensus estimates and showing growth from the $21.82 billion reported in the same period last year.

The company raised its guidance for full-year adjusted earnings growth to 25%, up from the previous 20%. However, Disney faced challenges after merging its Star India business with Reliance Industries, resulting in an impairment charge exceeding $2 billion.

Following the Q2 results, KeyBanc analyst Brandon Nispel suggested that soft guidance for entertainment streaming in the next quarter might temper enthusiasm. Nevertheless, Nispel emphasized that the news supports CEO Bob Iger’s argument that Disney is undergoing a much-awaited turnaround.

Nispel also highlighted that investors may perceive Disney’s cautious outlook for its Experiences business, including theme parks, as a negative factor for the stock. The company stated that third-quarter operating income for this segment is expected to be roughly comparable to the prior year.

During the earnings call, Disney CFO Hugh Johnston acknowledged a global moderation in post-COVID travel peak at its theme parks and noted that rising costs and inflation could impact profits.

Q2 standouts

During the second quarter, Disney observed a rise in Disney+ subscriber additions, particularly as Charter cable subscribers received complimentary subscriptions as part of their packages. The media giant exceeded its own guidance by adding over 6 million core Disney+ subscribers, surpassing Bloomberg consensus estimates of 4.7  million.

million.

Disney also experienced a positive trend in average revenue per user (ARPU), reaching $7.28, thanks to recent price increases and efforts to combat password sharing.

CEO Hugh Johnston emphasized the value of Disney’s content and hinted at potential future price increases for the streaming service.

In terms of its parks business, Disney achieved strong results with domestic operating income reaching $1.61 billion, driven by higher profits at Walt Disney World Resort and Disney Cruise Line, partially offset by lower results at Disneyland Resort.

However, domestic operating income at ESPN declined by 9% year over year to $780 million, attributed to reduced affiliate revenue and subscriber losses as more consumers opt out of traditional cable packages. Additionally, increased production costs for College Football Playoff programming contributed to the decline.

Within the entertainment division, domestic linear network revenue and operating income both decreased by 11% and 18% year over year, respectively, mainly due to lower affiliate and advertising revenue.

Disney’s focus on sports streaming was highlighted with the announcement of a joint venture partnership with Fox and Warner Bros. Discovery, as well as the development of a separate sports streaming platform for ESPN, expected to launch in fall 2025. Furthermore, Disney reportedly agreed to increase its media rights deal with the NBA to $2.6 billion, up from $1.5 billion, ahead of the current deal’s expiration at the end of next season.