Asian Paints disclosed its fiscal 2023-24 fourth-quarter results on May 9, indicating a marginal increase of 1.3% in its net profit to ₹1,275 crore, as opposed to ₹1,258.4 crore in the same period of the previous year.

The company, renowned as India’s leading paint manufacturer, experienced a slight decline of 0.6% in revenue from operations during Q4FY24, amounting to ₹8,730.8 crore compared to ₹8,787.3 crore recorded in the corresponding period of the preceding fiscal year.

Asian Paints announced that its board of directors has proposed a final dividend of ₹28.15 per equity share. In October 2023, the company had already declared an interim dividend of ₹5.15 per equity share for FY24, bringing the total dividend for the previous fiscal year to ₹33.30 per equity share.

Asian Paints Q4 Results – Key Metrics

During the fourth quarter, total expenses increased to ₹7,319.1 crore from ₹7,181.66 crore in the corresponding period of the previous year. The company’s Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) for the March quarter decreased by 9.3% to ₹1,692 crore compared to ₹1,865 crore in the same period last year.

During the fourth quarter, total expenses increased to ₹7,319.1 crore from ₹7,181.66 crore in the corresponding period of the previous year. The company’s Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) for the March quarter decreased by 9.3% to ₹1,692 crore compared to ₹1,865 crore in the same period last year.

Operating margin decreased by 170 basis points to 19.4% in the quarter under review, down from 21% in the year-ago period. The decline in fourth-quarter revenue was attributed to customers shifting to more affordable alternatives and the implementation of price reductions to navigate intensified competition, impacting the paint manufacturer.

Although volumes in the company’s core domestic decorative business increased by 10% in the quarter, revenue declined due to a subdued demand environment and customers opting for lower-priced alternatives, as stated by the company.

Asian Paints cited macroeconomic challenges in key markets like Nepal and Egypt as factors affecting revenue growth in its international business. The company’s board recommended a final dividend of Rs. 28.15 per equity share for the fiscal year ending March 31, 2024, pending approval at the upcoming Annual General Meeting.

With this final dividend, the total dividend for the fiscal year ending March 31, 2024, stands at Rs. 33.30 per equity share (representing a dividend payout ratio of 60%), which includes the interim dividend of Rs. 5.15 per equity share declared in October 2023 and paid subsequently, as stated in Asian Paints’ stock exchange filing.

Asian Paints has scheduled June 11, 2024, as the record date to identify eligible members for the final dividend for FY24. Pending approval by shareholders, the dividend will be disbursed on or after June 27, 2024.

Asian Paints has scheduled June 11, 2024, as the record date to identify eligible members for the final dividend for FY24. Pending approval by shareholders, the dividend will be disbursed on or after June 27, 2024.

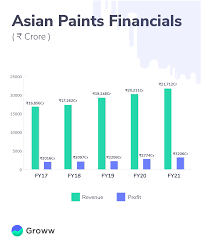

In fiscal year FY24, the company achieved a consolidated net profit of ₹5,557.69 crore, an increase from ₹4,195.33 crore in the preceding year. Revenue from operations for FY24 amounted to ₹35,494.73 crore, up from ₹34,488.59 crore in FY23.

Amit Syngle, CEO and Managing Director of Asian Paints, highlighted that in FY2024, the company surpassed the significant milestone of achieving consolidated revenue exceeding ₹35,000 crore. He emphasized that the Decorative and Industrial coatings segments collectively achieved a volume growth of 10% and a value growth of 3.9% for the year, with the industrial segment specifically achieving double-digit value growth.

Amit Syngle remarked that while the company’s international business experienced consistent growth in the Middle Eastern and African markets, it faced limitations due to macroeconomic challenges in South Asia and Egypt. Despite these obstacles, the company achieved robust profit performance in its global operations throughout the year.

Regarding the outlook for FY25, Syngle expressed confidence in an upturn in demand conditions, citing a favorable monsoon forecast. Asian Paints’ shares were recently trading 4.59% lower at ₹2,713.70 apiece on the BSE.

In conclusion, Asian Paints navigated through various challenges in fiscal year 2023-24, including a marginal increase in net profit and a slight decline in revenue from operations during the fourth quarter. Despite macroeconomic headwinds impacting international markets like Nepal and Egypt, the company maintained strong profitability throughout the year.

With a focus on enhancing shareholder value, Asian Paints announced a final dividend, bringing the total dividend for FY24 to Rs. 33.30 per equity share. Looking ahead to fiscal year 2024-25, the company remains optimistic about improving demand conditions, particularly with a favorable monsoon forecast. Overall, Asian Paints continues to demonstrate resilience and strategic agility in navigating market dynamics while sustaining its growth trajectory.