The Life Insurance Corporation (LIC) of India reported a 2.5 percent year-on-year increase in net profit at ₹13,762 crore for the March quarter of the financial year 2023-24 from ₹13,421 crore a year ago.

The profit after Tax for the year ending March 2024 was ₹40,676 crore as compared to ₹36,397 crore for the year ending 31st March 2023.

In terms of first-year premium income, LIC continues to be the market leader by market share in the Indian life insurance business with overall market share of 58.87 percent. For the year ended March 31st, 2024, LIC had a market share of 38.44% in Individual business and 72.30% in the Group business.

The Total Premium Income for the year ended March 31st 2024 was ₹4,75,070 crore as compared to ₹4,74,005 crore for the year ended March 31st 2023. The Total Individual Business Premium for the year ended March 31st 2024 increased to ₹3,03,768 crore from ₹2,92,763 crore for the comparable period of previous year.

The insurer sold a total of 2.03 crore policies in the individual segments compared to 2.04 crore policies sold in FY23.

The solvency ratio of the insurer was 1.98 percent against 1.87 percent last year.

Shri Siddhartha Mohanty, Chairperson, LIC said – “During the last year we have focused on directional changes in our product mix and enhancing margins in the business. We have more than doubled our share of non-par business within our Individual business. Now we intend to focus our strategic interventions to maximize our market share across categories. At the same time, our sharp focus on various parameters which create superior value for all stakeholders shall continue, as demonstrated.”

He added, “There are key initiatives related to distribution channel and digital transformation underway. We are confident that our employees, agents and our channel partners are fully committed to achieving these objectives. We look forward to this current year as the one in which our topline growth trajectory will be back in focus.”

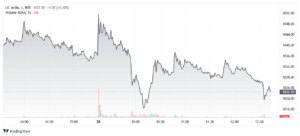

LIC’s stock price; dividend

The Board of Directors recommended a final dividend of Rs. 6/- per share for the financial year 2023-24 subject to approval of shareholders. Earlier, during the year an interim dividend of Rs. 4/- was declared and paid to shareholders of the corporation. Therefore, the total interim and recommended final dividend aggregates to Rs. 10/- per share.

Before the earnings were announced, LIC’s shares closed up 0.58% at ₹1,035.80 on BSE on Monday.

Today, the stock fell to as low as ₹1,018 on the NSE falling by 0.16 per cent.